Introduction

The decisions associated to investments are one of the most important decisions an organization has to make. Making investments is one of the main methods of increasing shareholders wealth (Warren, 2013). However this key area of long-term decision making poses many challenges for the management. Investment decisions in the simplest term is where an organization commits its funds in assets with the expectations of being able to earn a greater income than the funds invested. In other words the purpose of investments is to generate future income. In order to make the right investment decision from various options presented to the organization, they are put through the process of investment appraisal. Investment decisions are concerned with the capital assets of the organization which will yield returns in the future. They deal with the commitment of organizational resources and adding in to the capital asset base of the company with the expectation of future economic returns. A choice will be required to be made among available investment opportunities (McLeaney, 2009). These investment decisions could be of several types. Organizations make strategic investment s to build up their market presence. Such investments will not reap its benefits immediately. Investment in inventory is made to ensure smooth running of business. Another form of investment is modernization investments which brings the firm up-to-date with latest technology. The need for investment decisions arrives with the attainment of organization’s long-term goals.

Importance of Investment Appraisal

- Growth and Shareholder Wealth

Investment decisions influence the growth of the firm and shareholder’s wealth in the long run. The consequences of investment decisions expand in to the future and have to be borne for a longer period of time. These investments have a decisive impact on the direction of the firm’s growth (Petty et al, 2015). They will directly influence the size of the company and its business operations and thereby will impact shareholder wealth. One wrong investment decision can prove to be disastrous for the survival of the organization. Unnecessary expansion of organization’s assets will result in heavy costs. On the other hand lack of investments in assets will make it difficult to compete in the market.

- Large Funding Requirements

Investment decisions generally require a large sum of money making it imperative that the company plans ahead so that they can make arrangements for procuring funds in advance (Wood and Sangster, 2012). Investment programs must be carefully analyzed and the means by which the company expects to collect the required funds, internal or external should be arranged in advance.

- Irreversibility of Investment Decisions

Given the irreversibility of most investment decisions firms must make sure it doesn’t take any decisions that could lead to heavy losses (Hiller et al, 2011). Once an investment is made on a capital item it will be difficult to find a market for that. Therefore failure of such costly investment decisions could have a drastic affect on company profitability.

- Risks and Uncertainty related to Investment Decisions

Investment decisions call for a long term commitment of funds. Taking on such an investment will lead to an increase in gains but it could also result in frequently fluctuating returns (Jonathan, 2010). This will change the risk complexities of the firm and the firm might end up being considered more risky. This impact investment decisions have on the basic characteristics of the organization makes it imperative the firm carries an investment appraisal.

Investment Appraisal Techniques

The types of methods organizations use for investment appraisal can be divided to two categories namely traditional methods and discounted cash flow methods (Fridson and Alvarez, 2011). Traditional techniques include Payback Period and Return on Capital Employed (ROCE) whereas Net Present Value (NPV) and Internal Rate of Return (IRR) are discounted cash flow methods.

Figure 1: Investment Appraisal Process

Example

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Project A | (10,000) | 2,750 | 2,700 | 4,500 | 4,500 | 6,000 |

| Project B | (9,300) | 2,750 | 1,700 | 2,380 | 4,000 | 6,050 |

| Discount Rate | 15% |

Net Present Value

Net present value tells how much an investment adds to the shareholders wealth. Therefore the larger the NPV the more value it adds to the organization. This technique calculates the present value of the cash flows arising from the investment based on the opportunity cost of capital (Gibson, 2012). It shows how much a project contributes to the shareholders wealth hence goes in line with the overall goal of the company that is shareholder wealth maximization and takes time value of money under consideration. Unlike the payback period method, NPV consider all relevant cash-flows irrespective of when they occur.

| Project A | Project B | |||||

| Year | Cash-flow | Discounting Factor 15% | Discounted Cash-flow | Cash-flow | Discounting Factor 15% | Discounted Cash-flow |

| 0 | (10,000) | 1 | (10,000) | (9,300) | 1 | (9,300) |

| 1 | 2,750 | 0.870 | 2,391 | 2,750 | 0.870 | 2,391 |

| 2 | 2,700 | 0.756 | 2,042 | 1,700 | 0.756 | 1,285 |

| 3 | 4,500 | 0.658 | 2,959 | 2,380 | 0.658 | 1,565 |

| 4 | 4,500 | 0.572 | 2,573 | 4,000 | 0.572 | 2,287 |

| 5 | 5,000 | 0.497 | 2,486 | 5,050 | 0.497 | 2,511 |

| NPV | 2,450 | 739 | ||||

Advantages

- One of the main advantages of NPV method is that it takes time value of money in to consideration (Arnold, 2008). The basic idea of NPV is build around the fact that a future pound is worth less than a pound today therefore the future cash flows are discounted by the cost of capital.

- It considers future cash flow of the company and not the accounting profits like in ARR method. In addition NPV consider all relevant cash-flows irrespective of their occurrence.

- The timing of each cash flow is also considered under NPV. In general the cash flows expected in 5 years time is inherently less certain compared to the cash flow expected to occur the next year.

- NPV creates a monitory value instead of a rate of return (Binsbergen et al, 2010). The final product of the NPV method is the amount of value added to the company as a result of undertaking the project. This makes it easier for shareholder to understand the impact of the investment.

- NPV discounts its future cash flows based on the company’s cost of capital which is the minimum rate of return expected by the shareholders for their investment.

Disadvantages

- One of the biggest disadvantages of The NPV technique is that it requires the company to make a number of estimates. For instance if the estimate about the cost of capital is too low the company will end up accepting suboptimal projects. In contrast if the cost of capital estimation is too high it will result the company forgoing many profitable investments.

- NPV method might be less suitable when comparing projects will different initial outlays. It is also difficult to apply the NPV approach to projects with different life spans (Hall et al, 2010).

- The cost of capital calculated at the beginning of the project can change over time making future calculations less accurate.

Decision Rule

If the net present value is a positive figure by making the investment company can increase its wealth but if it is a negative figure it is advised to avoid such investments (Caglayan & Demir, 2014). If two projects are independent meaning cash flows aren’t affected by one another and NPV exceeds zero then both projects should be accepted but if they are mutually exclusive the project with the highest positive NPV should be accepted. If neither of the two projects has a positive NPV then both should be rejected. If both projects A and B are independent both should be accepted considering both have positive NPV values. However if they are mutually exclusive Project A should be selected considering it has the highest NPV.

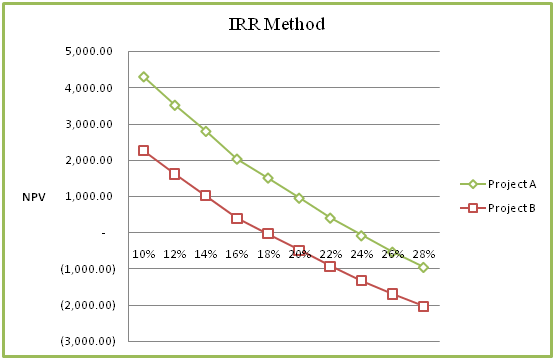

Internal Rate of Return

Another main technique of investment appraisal is Internal Rate of Return. This calculates the cost of capital at which the net present value of all cash-flows equal zero. In other words IRR is the discount rate that forces the present value of the cash inflows to be equivalent to the initial investment. It is the hurdle rate using which organizations decide to either accept or disregard a project. This technique is closely related to NPV and similarly uses discounted cash-flows in its calculations (Atrill and McLaney, 2013).

| |||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

Project A IRR Calculation

Project B IRR Calculation

Figure 2: Relationship between NPV and IRR

- Similar to NPV, IRR considers time value of money by using the present value of future cash flows in the calculation. Thereby each cash flow is given equal weight.

- The cost of capital is not needed in the IRR calculation. This mitigates any risks the company has of determining a wrong cost of capital.

- The suitability of the project is determined considering the entire economic life of the project.

- IRR method is directly linked to the ultimate goal of the firm which is wealth maximization.

Disadvantages

- IRR makes an assumption that the returns of the investment are reinvests at the internal rate of return which makes the it less realistic

- IRR doesn’t calculate the absolute amount of the investment’s return like NPV (Hovakimian et al, 2009).

- IRR can provide misleading results when it comes to projects with different sizes.

- A project with a high initial investment and a slow pace in returns will have a low IRR but can be of great value to the company.

Decision Rule

If the IRR exceeds the project’s cost of capital the project earns an extra return hence it is desirable. On the other hand if IRR is less than the project’s cost of capital it causes a reduction in shareholders wealth. Both IRR rates 24% and 18% are higher than the cost of capital of 15%. If the two projects are mutually exclusive the project with the highest IRR should be selected. In this case the project selected should be Project A.

Payback Period

The time required to recover the initial outlay made by the firm based on cash flow values is calculated by the payback period method (Watson and Head, 2007). One of the main drawbacks of this method is that it disregards the time value of money. In addition this method doesn’t reflect on the cash flows that come after the payback period.

| Project A | Project B | |||

| Year | Cash-flow | Cumulative Cash-flow | Cash-flow | Cumulative Cash-flow |

| 0 | (10,000) | (10,000) | (9,300) | (9,300) |

| 1 | 2,750 | (7,250) | 2,750 | (6,550) |

| 2 | 2,700 | (4,550) | 1,700 | (4,850) |

| 3 | 4,500 | (50) | 2,380 | (2,470) |

| 4 | 4,500 | 4,450 | 4,000 | 1,530 |

| 5 | 5,000 | 9,450 | 5,050 | 6,580 |

| 3.01 years | 3.62 years | |||

Advantages

- The simplicity of the payback period method is its most significant advantage. Comparisons between projects can be easily done and the result can be understood without difficulty by the shareholders.

- While discounted cash flow techniques like NPV and IRR take a considerable amount of time and effort, payback period method offers a quick evaluation.

- The payback period method calculates how quickly the project returned from the investment thus can be used to measure the relative risk of different projects (Pike and Neale, 2009).

Disadvantages

- Payback period fails to take time value of money in to consideration (Jones, 2008). If two investments produce similar payback periods but one of them generates more cash flow in the early years of the project this technique will fail to identify the wealth that project adds to the company.

- This method doesn’t reflect on the cash flows that come after the payback period. Thus it fails to compare the overall profitability of projects.

- Payback period method gives emphasis to liquidity rather than profitability. If the cash flows of a project with a short payback period reduce significantly after the payback period it might not be the most profitable option for the firm.

- In addition this method doesn’t consider about the required rate of return in its calculation.

- No clear relationship between payback period and shareholder wealth maximization is established.

Decision Rule

If all factors of two projects are similar the project with the shortest payback period is selected (Owen, 2003). If the organization can take on more than one investment it can put up a benchmark payback period and select projects that have a payback period less than the benchmark.

Return on Capital Employed

One significant difference between ROCE and previously stated investment appraisal techniques is that it uses the average accounting profit earned by the investment instead of cash flows. In this method the average profit of the investment is shown as a percentage figure of the initial investment (Dyson, 2010).

| Project A | ||||||

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Cash-flow | (10,000) | 2,750 | 2,700 | 4,500 | 4,500 | 5,000 |

| Depreciation | -1300 | -1300 | -1300 | -1300 | -1300 | |

| Accounting Profit | (10,000) | 1,450 | 1,400 | 3,200 | 3,200 | 3,700 |

| Project B | ||||||

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Cash-flow | (9,300) | 2,750 | 1,700 | 2,380 | 4,000 | 5,050 |

| Depreciation | -700 | -700 | -700 | -700 | -700 | |

| Accounting Profit | (9,300) | 2,050 | 1,000 | 1,680 | 3,300 | 4,350 |

| Year | Project A | Project B |

| 1 | 1,450 | 2,050 |

| 2 | 1,400 | 1,000 |

| 3 | 3,200 | 1,680 |

| 4 | 3,200 | 3,300 |

| 5 | 3,700 | 4,350 |

| Average Accounting Profit | 2590 | 2476 |

| Investment | 10,000 | 9,300 |

| ROCE | 25.90% | 26.62% |

Advantages

- ROCE of a project is simple and straightforward to calculate as well as understand (Brealey, 2012).

- The financial objective of the investment can be stated in terms of a target ROCE and the percentage figure is much simpler for the management to interpret.

- ROCE recognizes the net earnings of the investment after tax therefore gives a clear picture of the profitability

- This method is suitable to assess mutually exclusive projects.

Disadvantages

- ROCE uses accounting profits in its calculations and these can be manipulated by the organization using accounting polices like depreciation techniques. Accounting profit is more appropriate for reporting purposes whereas cash flows are more suitable to measure economic wealth.

- ROCE doesn’t take time value of money in to consideration. In this technique much like payback period a project with most of its cash flows in the near future and another project with most of its cash flow occurring in later years are given equal weight.

- The profit figure used in ROCE includes non cash items like depreciation

- ROCE is a relative measure hence investments with different initial outlays cannot be accurately evaluated

- By considering the average return of the project ROCE disregards the the life periods of the investments.

Decision Rule

If all factors of two projects are similar the project with the highest ROCE is selected (Baker and English, 2011). If the organization can take on more than one investment it can decide on a target ROCE and select projects that have a ROCE greater than the hurdle.

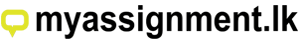

Weighted Average Cost of Capital

The average after tax cost of capital of an organization and be defined as the Weighted Average Cost of Capital (WACC). In other words this is the minimum rate of return the company anticipates to compensate its various fund providers (Christofferson, 2003). WACC is calculated by proportionately weighting the various sources of funds acquired by the company. The two main sources of financing for any organization are equity capital and debt capital. Therefore the two primary components of WACC are cost of equity and cost of debt. WACC is calculated using the cost of each element in the company’s capital structure and the relevant weight of that element (Berry and Jervis, 2005). WACC illustrates how difficult it is for the company to obtain funds and an increase in the WACC indicates a decrease in the firm value. The lower the WACC is the cheaper it is to fund that company.

Use of WACC in Investment Appraisal

WACC is used to assess the value of different investment so to determine which investment is worth perusing and which is not.

- For instance WACC can be used to discount cash flows as a discounting rate when calculating the NPV of a project.

- It can also be used in place for a target Return on Capital Invested (ROIC). WACC is also a helpful tool in controlling future investment cost of the company (Van Horne and Wachowicz, 2005).

- If a company wishes to bring down its WACC it can increase the use of the cheaper mode of finance based on the WACC.

R(E) = Cost of Equity

R(D) = Cost of Debt

W(E) = Weight of Equity

W(D) = Weight of Debt

t = Tax

Figure 3: WACC Calculation

Cost of Equity

The rate of return required by the shareholders of the company is the cost of equity (Brigham and Erhrardt, 2001). In other words it is the minimum amount of return the company has to make for its share price to remain the same. If the organization is unsuccessful in delivering this return the shareholders might be tempted to sell the shares which could ultimately result in a drop in the share price. Since the cost of equity financing doesn’t have an explicit value calculating the cost of capital can be quite complicated. Unlike debt capital which has a predetermined cost associated to it in the form of interest, equity financing has no such fixed price the company is bound to pay (Drury, 2008). Organizations employ various techniques like Dividend Growth Method and Capital Asset Pricing Method (CAPM) to calculate cost of capital.

Dividend Growth Model

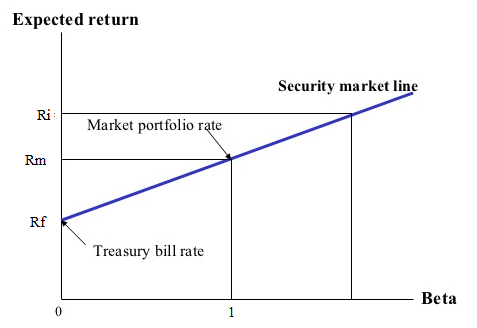

Capital Asset Pricing Model (CAPM)

ri = rf + B ( rm – rf )

ri = Required Rate of Return on ith stock

rf = Risk free Rate

rm = Required Rate of Return on the Market Portfolio

B = Beta Coefficient of the Security

Figure 4: Capital Asset Pricing Model

Cost of Debt

The yield to maturity of the debt instruments of the company is used to obtain the cost of capital (Brigham and Houston, 2009). When a company acquires debt capital a prearranged interest rate is decided based on the amount and the time period of the debt. The after tax cost of debt is used in the WACC calculation because of the tax shield received by debt financing.

Conclusion

In conclusion all investment appraisal techniques have their strengths and weaknesses but NPV is considered the most suitable considering it has a clear link with shareholder wealth maximization and is an actual measure of the value added to the company by investing in the project. However the information provided by other techniques should be considered when making the final decision. The report also discusses the concept of weighted average cost of capital and its various uses.

Bibliography

Abdullah, A. (2005), ‘Capital structure and debt maturity: evidence from listed companies in Saudi Arabia’, Journal of Business and Economics

Alexander, C. (2008), Market Risk Analysis, Wiley & Sons

Bellamy, J., & Benson, S. (2012), U.S. Patent office, Washington, DC

Crosson, S.V. and Needles, B.E. (2011), Management Accounting, Cengage Learning

Deesomsak, R., Paudyal, K. and Pescetto, G. (2009), the determinants of debt maturity structure: evidence from the Asia Pacific region, Journal of Multinational Financial Management

Garison, R. H. and Eric W. N. (2000), Managerial Accounting, Mc Graw-Hill Companies Inc

Grant, R. M. and Jordan, J. J. (2012), Foundation of Strategy, John Wiley and Sons

Jorion, P. (2006), Value at Risk: The New Benchmark for Managing Financial Risk, 3rd Ed, McGraw-Hill

Langfield-Smith, K, Thorne, H. and Hilton, R. (2012), Management Accounting, New South Wales: McGraw Hill

Lesakova, L. (2007), “Uses and Limitations of Profitability Ratio Analysis in Managerial Practice”, International Conference on Management, Enterprise and Benchmarking

Stoner, J. A. F. And Freeman, R. E. (2009), Management, Harlow: Prentice Hall

Winton, A. and Yerramilli, V. (2007), Entrepreneurial Finance: Banks versus Venture Capital, Journal of Financial Economics

References

Arnold, G. (2008), Corporate Financial Management, London: Pearson Education Limited

Atrill, P. and McLaney, E. (2013), Accounting and finance for non-specialist, Harlow: Prentice Hall

Baker, H. K. and English, P. (2011), Capital budgeting valuation: Financial analysis for today’s investment projects, Hoboken, N.J: Wiley

Berry, A. and Jervis, R. (2005), Accounting in Business context, Hampshire: Cengage Learning

Binsbergen, J. H. V., Graham, J. R. and Yang, J. (2010), The Cost of Debt, The Journal of Finance

Bodie, Z., Kane, A. and Markus, A.J. (2014), Investments, McGraw-Hill

Brealey, R. A. (2012), Principles of corporate finance, Tata McGraw-Hill Education

Brigham, E. and Erhrardt, M. (2001), Financial management: Theory and Practice, Cengage Learning

Brigham, E. and Houston, A. (2009), Fundamentals of Financial Management, Cengage Learning

Caglayan, M. and Demir, F. (2014), Firm Productivity, Exchange Rate Movements, Sources of Finance, and Export Orientation, World Development

Christoffersen, P.F. (2003), Elements of Financial Risk Management, Academic Press

Drury, C. (2008), Management and cost accounting, Pearson Education Limited

Dyson, J. R. (2010), Accounting for non-accounting students, Pearson Education Limited: England

Fridson, M. S. and Alvarez, F. (2011), Financial statement analysis: a practitioner’s guide, John Wiley & Sons

Gibson, C. H. (2012), Financial Reporting and Analysis, Ontario: South-Western Pub

Gowthrope, C. (2005), Business Accounting and Finance for Non Specialist, Bedford: Thomson Learning

Hall, D., Jones, R., Raffo, C., Anderton, A., Chambers, I., and Gray, D. (2010), Business Studies, 4th Ed, London, Pearson Education

Hillier, D., Grinblatt, M. and Titman, S. (2011), Financial markets and corporate strategy, McGraw Hill

Hovakimian, A., Opler, T. and Titman, S. (2009), The Debt-Equity Choice, Journal of Financial and Quantitative Analysis

Jonathan, B. (2010), Financial Management, Pearson Education

Jones, M. (2008), Accounting for Non-specialists, New Jersey: Pearson Prentice Hall

McLaney, E. (2009), Business Finance: Theory and Practice, London: Pearson Education Limited

Owen, A.S. (2003), Accounting for business studies, Burlington: Butterworth-Heinemann

Petty, J. W., Titman, S., Keown, A. J. and Martin J. D. (2015), Financial Management: Principles and Application, Pearson Education Limited

Pike, R. and Neale, B. (2009), Corporate Finance and Investments, Pearson Education Limited

Ross, S. (2012), Fundamentals of Corporate Finance Standard Edition, McGraw-Hill

Van Horne, J. C. and Wachowicz, J. M. (2005), Fundamentals of Financial Management, Pearson Education

Warren, C. S. (2013), Financial and managerial accounting, Cincinnati: South-Western

Watson, D. and Head, A. (2007), Corporate Finance- Principles and Practice, Pearson Education Limited

Wood F. and Sangster A. (2012), Business Accounting, Pearson Education Limited

One comment