1.0 The company report

1.1 Introduction

The paper focuses on EFG, one of the smaller banks that have been operating in the highly competitive Sri Lankan banking market. The bank is backed by one of the largest conglomerates in the country;ABC . EFG, has been operating in the Sri Lankan market since 1999 and currently has a branch network of 93 positioned in various districts of the country. The bank continues to invest in increasing the services portfolio it provides to the customers. It identifies customers who seek unique services and caters to their exact needs.

Irrespective of the development of these unique services and being able to expand the services fast, the bank has only been able to gain a smaller market share in this highly competitive market. EFG, accounts for 3% of the banking assets of the country as identified by First Capital (2016) as at end of 2014. This shows that the bank remains relatively small in the market, and it has to identify the strategic position that it seeks to retain in the banking industry of the country. If it fails to identify as to what it has to do in this industry, it is likely that it will fail to safeguard its position in the industry and reach the results.

The paper evaluates how the bank will be able to change this strategic dilemma and make sure it continues to grow. The steps that the bank will have to take to ensure growth will remain important and this will further indicate as to how the parties will be able to place themselves in an advantageous position that will provide them with the beneficial outcomes in the future. In order to achieve these aspects, the external as well as internal aspects have to be evaluated and the requirements identified.

1.2 Situational analysis

Analysis of the situation is required to identify the likely performance of the bank in the future and the current performance of the bank when compared with the competition it is facing (Davies, 2000). External factors, internal factors and the market performance factors have to be identified.

1.2.1 External factors

Macro and industry specific factors have to be identified through this analysis; the macro factors should indicate the changes that are taking place in the wider environmental context while the industry analysis should indicate as to how the industry behaves (Bowman, 1995). These provide the backdrop to which the performance of the company could be compared.

1.2.1.1 Macro environment

Political, economic, social and technological factors have to be used for the development of a clear understanding of this discussion. Thus, the PEST model will be helpful in evaluating the changes that are taking place in this market space (Parnell, 2010). The changes in these factors should highlight what steps the banks will need to take to achieve the required results (Dandira, 2012).

- Political – The country is a political democracy and any government in power has economic growth as a part of its policies. The banking sector activities will face minimum issues due to the changes of the governments. Thus, the political climate adds to the stability of the economic growth activities.

- Economic – In 2017, the country has seen a growth in excess of 3.8%; the World Bank has estimated the economy (Trading Economics, 2017) to accelerate in 2018 with 5.0% growth (The World Bank, 2017). This shows that the economic growth trajectory is up and accelerating.

- Social – The banking sector penetration is increasing; there were deposits valued at Rs.5.4 trillion in the banking system of the country in 2015 compared with Rs. 4.7 trillion in 2014, which shows 15% year-over-year growth. The loan portfolios have grown, indicating many people have access to banking facilities (Central Bank, 2018).

- Technological – Banking based on technology is increasing; for instance, mobile banking is gradually taking over a majority of the transactions surpassing the internet-based banking. It is possible that the manual banking activities will also be taken over by such systems in the future.

1.2.1.2. Industry outlook

For analysis of the industry scenario, it is best that Porter’s five forces analysis is carried out. This should indicate the main pressures that the incumbent players are facing (Völpel, 2002). The following analysis is affiliated with the banking sector of the country.

- Bargaining power of the customers – High – the customers can select a suitable bank from 25 commercial banking players that are available for them to invest in (Central Bank (a), 2018). They will be able to bargain and identify the best players who offer them the best solutions.

- Bargaining power of the suppliers – Low – the suppliers are low and the effective bargaining power of these parties remains low. The banks are larger players and they have the upper hand when it comes to bargaining with the other parties.

- Threats from new entrants – Low – the banking sector of the country remains saturated and the growth potential is limited; capital requirements are challenging and these will mitigate the potential of any future players entering the market.

- Threats from substitutes – Low – while there are non-banking financial institutes, the efficiencies of the services and the risk management has better placement with the banks. This places the banks in an advantageous position over the others.

- Competitive rivalry – High – the competition between the banks remains high. This is due to the needs that the banks have to differentiate their services from the others. There are 25 banks and over 40 non-banking financial institutes competing for a share of deposits and investor assets (Central Bank, 2018). The large stake held by the state banks (42% asset share) also contributes to a high level of competition (First Capital, 2016).

1.2.2 Internal aspects

The banking sector asset base has grown by 18.9% in 2015 compared with the previous year (Central Bank, 2017). This could be compared with the 9.0% increase of the net asset base of CTB.

The bank has been able to see the asset base grow during the year irrespective of the fact that the revenue has seen a 2.0% decline for the period. This shows that the bank has not been able to grow in line with the above market growth during the last financial year. Net profit margins for the bank have increased to 12.8% in 2015 compared with 9.7% in 2014 (Ceylon Trust Bank, 2016). This shows that, irrespective of the revenue growth, the bank has been able to continue to grow the profits from the operations. It is further important to note that the bank is a part of the conglomerate of companies and these synergies also act as a factor that contributes positively to the growth of the bank in the future. The bank having over 92 branches and another 54 leasing operations throughout the country also can be highlighted as a strength, irrespective of the fact that it has a relatively smaller market share (Ceylon Trust Bank, 2016).

1.3 Change drive

1.3.1 Digitization of the services

The banking sector of the country has seen increased digitization taking place; in other words, the usage of digital platforms for financial transactions is increasing. While internet banking has been an aspect that was in operation over the past few years, it is clear that further digitization is required to achieve the demand for mobile banking sectors in different banking contexts. While mobile pay is not yet available in the country, it is likely that mobile pay will replace credit cards in the future. Some of the primitive level mobile pay apps have been introduced by the telecommunications operators with limited options in the past few years. However, the system is no closer to reaching the internal mobile pay systems that are available.

This is an area that EFG, will be focusing on in the future. The bank has the ability to take the front seat in driving the mobile pay option in the future once the Central Bank of Sri Lanka allows the system to be operational. This will reduce the difficulties of payment and the customers will be able to use their mobile smartphones. Sri Lanka has a high mobile penetration rate in the South Asian region with a penetration level of 126% in 2015, and this is expected to continue to grow modestly until 2022 (Budde.com, 2017). The smartphone and 4G penetration levels are growing as well. All these aspects indicate that the industry is well placed with the ability to achieve continuous growth in the future.

The Chairman’s report of the Annual Report-2015 has identified the important role played by the digitization requirements, and the bank expects to take the lead in this segment. However, it is important to identify that this calls for a completely changed approach in the market. Thus, the bank has also identified the strategic need for the direction change and expanding the digital platforms of the bank rather than increasing the networks associated with the physical presence. This will reduce the overall operating costs of the bank while the customers can carry out their transactions from the locations in which they are situated (Lanka Business Online, 2017). The need to visit the bank can be almost completely eliminated provided the digital platforms are developed appropriately. This will benefit the bank and the customers alike.

1.3.2 Balance scorecard evaluation

In order to develop strategic map perspectives, the key aspects of the balance scorecard have to be evaluated. This would indicate the current performance of the bank. The balance scorecard evaluates the qualitative as well as the quantitative performance aspects in a balanced manner (Okcabol, 2007).

- Customer results – the bank has not clearly disclosed the customer base growth details even though in 2015 it disclosed its customer base to have reached 500,000. The deposit base of the bank has increased to Rs.176.3 billion by end of 2015, reporting an 11% year-over-year growth. The loan base has also grown by around 24% year-over-year during the same period (Ceylon Trust Bank, 2016). This indicates that the customer base and the transaction volumes are growing.

- Operations – the bank has been expanding its services throughout the country; the bank seeks to increase the physical presence and has established over 92 branches and 131 ATM machine points. In addition, there are 54 leasing centers established, and the bank has operations in 22 districts. Thus, the bank has been increasing its physical presence appropriately.

- Employee learning and growth – CTB’s training activities are primarily focused on improving the service quality for the customers.

To ensure the objectives set by EFG, are reached, the bank has invested Rs.67 million in training activities during 2015. The training hours were as high as 5,648 for the period (Ceylon Trust Bank, 2016).

- Financial results – the bank has seen the revenue decline by 2% in 2015. However, it has been able to grow the net profits by 3% during the same period (Ceylon Trust Bank, 2016). This is due to the ability to control the expenditure and remain focused on the profitability.

Thus, the above aspects indicate that all the aspects of the bank have seen progress over the past few years. It is important to identify how the bank has to change different aspects with a view to increasing digitization of the banking activities in the future.

1.3.3 New digitization platform

The strategy map perspectives will have to be developed to identify as to how the new digitization platform is likely to impact the overall performance of the bank in the future. Taking the needed strategic direction towards digitization will facilitate EFG, to achieve positive results and benefit in line with expectations the bank is likely to have in place.

- Learning and growth – There are four key areas that have to be linked with this perspective; culture, leadership, alignment and teamwork are these four key areas.

- Culture – the organizational culture has to be developed to be more online oriented where the employees would be able to provide services online based on an available platform. For instance, chatting with the customers to provide assistance rather than face-to-face encounters. Thus, the culture has to be more online interaction based. The dynamism which is required for these changes has to be found within the bank culture.

- Leadership – the leaders will have to provide the required resources for the change; these may include appropriate information technology resources and the training that the employees may need to transit successfully from the current model to virtual banking and the digital model.

- Alignment – the employees may need training on the new systems and the way they take leadership to provide services over the digital platforms that are available. These training programs will also facilitate their growth in the future.

- Teamwork – the employees need to be provided with the chance to work as teams, share their knowledge and ensure that they develop themselves and the capabilities to meet the future challenges that they have to face.

Internal perspective – this looks into the operational management process, innovation process, customer management and the regulatory processes.

- Operational management – the company has to develop the digital operations capabilities; this includes linking the payment platforms with the shops and other parties who have to receive the payments. Further, the customer payment methods (Master, Visa and Amex) have to be linked with the digital payment platforms. This might require development of a comprehensive set of IT facilities within the bank.

- Innovation – the bank will be able to develop innovative services associated with the digital platforms. These will further increase the customer association with the bank. The lives of the customers will be improved due to these platform development activities.

- Customer management – the customers will have to be informed of the new platforms and the likely benefits they could achieve. They have to be aware of how they can use these new services and eventually benefit from these outcomes.

- Regulatory process – the systems have to have the right security and the approval from the Central Bank will have to be obtained. This will ensure that EFG, provides a unique set of services to the customers that will benefit them in an increased manner.

Customer perspective – In this context, the product attributes, relationship and the image have to be discussed. The following indicates these details.

- Product attributes – the bank will now be able to provide its services over mobile phones; the features such as access to bank account details, fund transfers as well as the payment activities can be carried out using mobile phones. This will enable reducing the customer visits to the bank branches due to the fact that there will be minimum need for such visits.

- Relationships –the customer will be able to access the banking services without any limitations in terms of the time and the activity. Further, they are more in control of these activities. This will enhance the customer confidence and ensure the customers will be able to trust the bank more.

- Image – the image of the bank becomes modern and closer to the needs and the expectations of the customers. Thus, the bank will be able to attract more customers who expect a modern set of services in line with the needs they have.

Financial perspective –utilization of the assets, the ways the costs are structured, revenue opportunities and the customer value enhancement are the main areas that are associated with the financial perspective.

- Cost structure – the bank will serve the customers online and this means that the actual physical effort taken is mitigated. This will save costs for the bank. Thus, the bank will be able to reduce the costs involved with the services.

- Asset utilization – the requirements of the physical assets would reduce and the bank will be able to expand the services over the digital platforms; for instance, smartphone-based payment systems might reduce the need for ATMs.

- Revenue opportunities – this is expanded as more customers who seek convenience in the banking services will be attracted to the services provided by the bank. They will be motivated to seek more services and will continue to work with the bank in the future.

- Customer value – the customers now receive more services from the bank and they will be highly satisfied with these services. They will also believe that the bank will continue to invest in further enhancing the service platforms over the digital aspects.

1.3.4 Summary of outcomes

Thus, the above aspects indicate that the digitization of the banking platforms will allow the bank to reduce the asset investments and work with the customers online. The customers, on the other hand, will have the banking services provided to them over the mobile phones. This reduces the need for them to visit the banks. The unique and innovative set of services will maintain the customer loyalty with the bank and benefit the bank in the future.

1.4 Results of failing to implement the changes

It is also important to note that failing to carry out these changes could provide negative results for the organizations. The bank has identified the need for digitization even in the Chairman’s report. It is also clear that even though the digital payment laws are not fully in place, there will be changes to the current approach soon and the required regulatory framework will be in place. If EFG, is not at the forefront when these changes are introduced, it is likely that it will not be able to achieve the desired results through these changes that are likely to take place.

The bank will not be able to change with the changes in the banking trends of the country. It is also clear that such failures would lead the bank to limit its capabilities in reaching the right outcomes in the future context. Thus, the bank will not be able to attract the customers. The eventual result is that the bank will lose the market share it is holding. The market changes will create a negative impact overall if the organization fails to respond to these changing needs. All these aspects would provide negative outcomes and the results are not likely to produce positive benefits to the bank.

1.5 Conclusion

EFG, is a bank that has a smaller asset share in the competitive banking market of the country. The bank has identified that digitization is the best approach for it to develop the required changes and reach the results that matches the market expectations. It is important to note that the bank will have to identify the technological and the people-related changes in order to realize these needed outcomes. Such changes will lead it to achieve expected outcomes and eventually benefit related to sustainable development aspects in the future context. Thus, EFG, will be able to benefit from the changes in the future.

2.0 Literature Review

The companies have to change their activities in line with the changing requirements of the market. It is possible that the changes will have to be anticipated as the changes that the markets will need might not be evident in all cases. Thus, the companies have a responsibility to make sure they have a clear understanding about these issues and thereby provide appropriate outcomes. Once they evaluate the direction the market is likely to take, they will be able to formulate the right strategies and make sure they continue to grow and benefit from the business activities that are affiliated with them.

2.1 Deciding on the strategic direction

The environmental scenarios will have to be identified; in order to do this, the company has to use tools that facilitate the analysis of the macro as well as the industry factors. The macro factors are affiliated with the wider business environment. For analysis of this, an appropriate model should be used. The widely used model in this context is the PEST model where the key factors of the macro context are evaluated (Kolios and Read, 2013). The political, economic, social and technological aspects are the main areas that would impact the strategic direction of any organization, and these factors highlight these key areas under consideration.

Figure 1 – PEST model

Further, the industry scenarios also have to be evaluated; there are many forces that the organizations will have to face and these forces will have to be identified and appropriate steps will have to be taken to evaluate them appropriately. For this purpose, the study would use Porter’s five forces model. This will indicate the overall attractiveness of the industry of the incumbent players as well as the potential newcomers to the industry. This evaluation also remains important in this context. Thus, the above aspects should indicate the strategic direction of the company.

Figure 2 – Porter’s five forces model

The above models highlight that the key environmental aspects and the attributes have to be evaluated in order to establish the main situational aspects these companies might have to face. However, it is further important to note that areas such as the competition as well as the internal capabilities of the business also have to be evaluated to identify the situation that the business is facing (Ogutu, 2015). These scenarios will allow the business to establish appropriate operations and eventually benefit by achieving the appropriate targets and reaching the points of expectations that are in place.

2.2 Evaluating current performance

To evaluate the current performance, the organization has to use an approach that facilitates evaluating the qualitative as well as quantitative aspects. This is the reason the balanced scorecard should be used in this scenario. The model facilitates evaluating the qualitative as well as quantitative performance aspects. Thus, the overall performance of the organizations and the issues and benefits affiliated with these areas can be identified (Niven, 2014).

Figure 3 – Balanced scorecard (Kaplan and Norton, 1996)

Learning and growth – the organizations have to invest in the improvement of employee skills; improving employee skills will result in the increase of the employee performance levels. High performing employees will eventually improve the performance of the organization overall. Thus, the learning and the growth focus of the organizations remains vital. This shows that learning and growth remain areas of high importance for the learning and growth implications.

Internal operations – the companies will have to evaluate the nature of the internal operations and how these internal operations impact the overall business activities. Knowing the nature of the internal operations and the outcomes that they have provided to the organizations remain vital for the organizations to achieve the needed outcomes in the future context. The reachability, efficiencies and the capabilities have to be developed to meet the exact needs of the markets, provided these organizations seek to fulfil the needs of the markets in the future.

Customer results – the customers have a certain set of needs, and aspects such as the revenue growth, new customer acquisition and the market share would indicate as to how the customers are working with a given organization. Thus, the customer-related results orientation remains vital for the organizations in order to achieve the right outcomes in the future. Customer results naturally remain another important area for them to work in and achieve the outcomes.

Financial results – this indicates the ultimate performance of an organization. Profitability and the other financial aspects are vital to highlight how an organization would perform. Thus, the right kind of steps will have to be taken to enhance the overall profitability and the other aspects of the financial performance. This shows how the organizations are performing currently and how they will be able to improve their future financial performance aspects.

Thus, the above model provided the basis for evaluation of the companies under consideration. This will indicate the positives as well as the negatives. In the case of CTB, it is clear that the bank has a smaller market share and the bank will have to develop an appropriate set of targets for it to gain increased market share in the future (Henderson, Young and Mittl, 2017). The company has to develop internal capabilities, learning focus and customer orientation to suit the new digitization strategy of the bank.

2.3 Deciding on emerging strategies

The companies have to identify the best strategies that they need to develop; Ansoff’s product and market development matrix indicates the main strategies that they can develop. This matrix will indicate as to how and what strategies have to be developed and how they are likely to contribute to the development of the organizations in the future.

Figure 4 – Ansoff’s product and market development matrix

The model highlights that the companies could penetrate the existing market, they could also work to develop new products, they could reach other markets with the existing products, or totally diversify the business by reaching new markets with the new products. Thus, the model is useful in developing the right strategies. In this instance, the bank is seeking to offer the existing markets with a totally different value through the digitization process (Haapalainen and Skog, 2011). This will allow the markets to enjoy a new set of benefits they have not been able to enjoy in the past. Thus, the bank is seeking to use the product development strategy and with this, they are hoping to attract new customers. This will allow them to reach a total diversification outcome in the future.

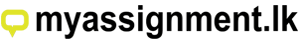

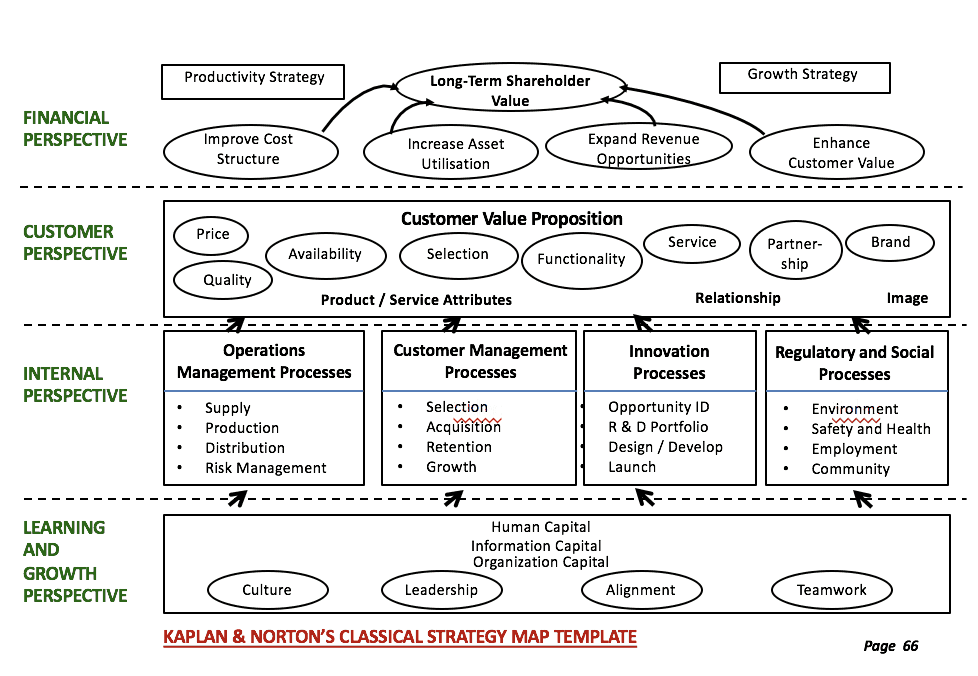

2.4 Strategy map

This would allow the bank to identify the key areas that have to be developed at each stage to establish the new strategy. The role of the strategy map thus remains vital as that would provide a detailed planning framework when changes of this nature are taking place. This will ultimately remain important in these areas.

Figure 5 – Strategy map (Kaplan and Norton, 2007)

Under learning and growth, culture, leadership, alignment and teamwork remain areas of importance. The organization has to develop approaches to cover all these areas and improve performance in all these aspects (Braam and Nijssen, 2008). Culture changes have to be established through training and appropriate support. With digitization, the employees are empowered more and they should be able to handle such changes. The leadership will have to be developed and the organizational leadership has to provide the facilities required for changes (Gomes and Liddle, 2009). Alignment is important because the skill improvements have to be aligned with the changing requirements and the teamwork has to be developed to gain knowledge, share experiences and ensure the change process will achieve the eventual results that are expected.

Internal perspectives are linked with the operations management, customer management, innovation and regulatory aspects. Operations have to change to meet the needs.

The customer management process has to be upgraded and innovation has to be a part of the change. This will allow the organization to develop services that are new and the parties will be able to achieve positive results through these changes (Bielavitz, 2010). The organizations, on the other hand, have to ensure that they look to the management of the regulatory aspects where there is such a need.

When the customers are considered, the products have to have the features the customers need. On the other hand, the prices of the product also have to meet the expectations of the customers. This facilitates the products to meet the needs of the customers and contribute to gaining market share while retaining the expecting customers (Khomba, 2011). The products have to be available as needed and the services have to achieve the expectations of the customers as well. All these areas indicate that the eventual products and the services provided will meet the customer expectations in the future.

Ultimately, all these aspects will have to be reflected in the financial performance of the company. The financial performance indicates that the costs have to be reduced while the revenues are increased. This will further indicate that asset utilization has to be increased and the customer value that is provided will need to be enhanced (Kim, Suh and Hwang, 2003). These will ensure the organization is capable of providing the parties with the values that they need.

The overall aspects show that when the bank starts the digitization process, it has to improve the internal employee capabilities and develop the culture, leadership and the teamwork. The internal operational aspects could then be developed in order to focus on the customer needs (Self and Tolson, 2008). Innovative services will have to match the exact customer requirements. These will eventually benefit the parties and lead to achieving the right outcomes. Thus, the bank will be able to meet the expectations and grow as a bank that has an appropriate customer focus in the services provided.

2.5 Research perspective

The background in which the company is operating can be identified through the political, economic and the social facts that are involved.

The technology-related details such as the smartphone penetration etc. should also be helpful. There are many reports on the banking sector of the country and this should indicate the industry details and the role that EFG, plays within this competitive industry space. Thus, these aspects remain important areas that will indicate the macro and the industry-related perspectives that will provide appropriate results in the future.

The organization’s internal performance aspects have to be identified; it is important to note that the bank publishes many related details about the performance through the annual report. This will provide details about the customer base of the bank, the growth of the financial indicators and the other related aspects. The annual report will remain as one of the important sources that will indicate the operations, and customer growth as well as the internal aspects. The annual report also highlights the key learning and growth steps that the bank has taken. Thus, the internal aspects related to the annual report are likely to drive the right results.

It is also important to note the steps that EFG, has taken to digitize the operations and make sure it reaches the right outcomes from the process. In order to identify these aspects, interviews with the current employees were useful. Apart from the secondary data, primary data from the employees have been a source that has assisted in the study to identify the actual direction of the bank and how the bank is seeking to improve the overall quality of the services it provides.

3.0 Reflection

This section will evaluate the learning process associated with the study and how the outcomes of the study were arrived at. Further, these areas indicate as to how the author has been able to gather the required knowledge and make sure that the right information is gained. It is vital to use the right kind of theories to reach the appropriate conclusions in these areas as well. Thus, utilization of the right knowledge and application of the appropriate models would remain vital to achieve the appropriate results and maximize the benefits associated with the parties. This will allow reaching the appropriate targets and benefitting from the outcomes in the future.

3.1 Critical thinking and core capabilities required

The study involved evaluation of the outcomes associated with a company with a view to identifying the right outcomes. The study evaluates the appropriate insights related to the study area and provides the appropriate benefits in terms of the insights that are associated with this. Ceylon Trust Bank is one of the smaller banks that are operating in the country and the key benefits as well as the issues that it faces will have to be evaluated to reach the right outcomes. The insights that are provided have to be identified in detail.

The bank’s main issue is the difficulty of growth; this is due to the fact that the growth within the industry is limited and the industry saturation creates a scenario that is hard for the smaller banks to survive. Many of the smaller banks are encouraged to consolidate with a view to gaining the upper hand over the larger commercial banks in the market. This is a challenge for the banks and they seek to ensure that they achieve the right results through appropriate activities and strategic development. Thus, EFG, will naturally need to identify the best options it has.

Critical thinking is vital to evaluate as to what the bank will have to do to develop its competitive advantage. The banking sector has many banks and there is a very high level of competition in the sector. This naturally highlights the fact that the competitive advantage-building is at the core and critical evaluation of the current capabilities and the competitor scenarios will indicate what the bank will have to do. This is the main area that was focused on when the critical strategies for the bank were developed to achieve the future objectives of the bank.

Apart from the critical thinking, the study has to have the capabilities affiliated with the collection of the required information. This will allow evaluating the insights associated with these areas and reaching the right outcomes in the future. The sources of the information have been identified and the relevant information for the study has been collected. Further, evaluation of the information and carrying out the required analysis is also important. This will show the current situation of the bank and how the bank will be able to develop appropriate outcomes that will benefit it in the future.

When collecting the primary information, the capability of communicating is vital. The respondents have to be convinced that the information they provide would remain confidential and will not be revealed to outsiders with the details of the respondents. Thus, the outcomes will provide the right benefits and lead to knowing the needed information about the bank. It is also important to evaluate the appropriateness and the relevance of the information provided. These will ensure that I gain the right insights into the areas of communication and then achieve the appropriate benefits in the future context.

3.2 Current skills

I naturally found completing the assessment challenging due to the lack of skills in certain areas. I had to obtain the required skills to make sure that I completed this assignment in line with the needs that are in place. One of the areas that I had to work on improving was my analytical skills and the ability to relate those to a future context. While the problem of being small has been identified, the actual issues related to this and the repercussions were difficult to identify. However, the study has been able to provide the required insights related to these areas and how the parties will be able to benefit from the outcomes.

I also had to develop the required communication skills to collect the data. This was another tough aspect as I had to convince the employees to provide me with information about the company and the future directions that they will take. The subjective as well as the objective insights were useful for the development of my opinion about the issue affiliated. Thus, the study has been able to provide useful information about key aspects related to the study. Development of these skills allowed me to identify the issues and how best I can suggest changes.

3.3 Leadership skills

The leadership skills have provided me with a number of benefits; i.e. the drive to identify the actual reasons behind EFG, being small and how the bank can actually grow in the future. I have been able to discuss the details of the work with various stakeholders including some of the customers of the bank, the employees and neutral parties to get a preliminary understanding of the issue. I was organized and tried to remain relevant to each of these areas under discussion. This has allowed me to identify as to how I will be able to suggest appropriate solutions to the problems involved.

I believe that better communication and the capability to convince have allowed collecting more related and accurate information about the organization. This has allowed me to identify the right outcomes related to the bank and how these will have to be implemented. Thus, the recommendations related to this study area were developed in line with the information that was collected. Thus, the insights that are provided by the study would remain highly useful to achieve the right results.

4.0 Conclusion

Thus, the above paper indicates the main literature areas that were helpful in evaluating the bank and the role played by the bank. The bank has to achieve prominence in the context of customer care and service provision. In order to achieve such results, the bank has been able to identify that digitization is the best approach it should take. However, it is also important to note that the bank has to take the right steps to improve the overall benefits in place and reach the targets that are set for it. This approach will ensure that it will achieve the beneficial results in the future context.

References

Bielavitz, T., (2010). The Balanced Scorecard: A Systemic Model for Evaluation and Assessment of Learning Outcomes?, Evidence Based Library and Information Practice, Pages, 35 – 46.

Bowman, C., (1995). “Strategy workshops and top‐team commitment to strategic change”. Journal of Managerial Psychology, Vol. 10 Issue: 8, pp.4-12.

Braam, G., and Nijssen, E., (2008). Exploring the Antecedents of Balanced Scorecard Adoption as a Performance Measurement and Strategic Management System. [online] Available at: http://webcache.googleusercontent.com/search?q=cache:BwJzbBfEfnEJ:www.ru.nl/publish/pages/516298/nice_08115.pdf+&cd=18&hl=en&ct=clnk&gl=lk, [Accessed January, 2018].

Budde.com, (2017). Sri Lanka – Telecoms, Mobile, Broadband and Digital Media – Statistics and Analyses. [online] Available at: https://www.budde.com.au/Research/Sri-Lanka-Telecoms-Mobile-Broadband-and-Digital-Media-Statistics-and-Analyses, [Accessed January, 2018].

Central Bank of Sri Lanka (a), (2018), Licensed Commercial Banks. [online] Available at: http://www.cbsl.gov.lk/htm/english/05_fss/popup/licensed_cb.htm, [Accessed January, 2018].

Central Bank of Sri Lanka (b), (2017). Finance Sector Performance and System Stability. [online] Available at: http://www.cbsl.gov.lk/pics_n_docs/10_pub/_docs/efr/annual_report/AR2015/English/12_Chapter_08.pdf, [Accessed January, 2018].

Dandira, M., (2012). “Strategy in crisis: knowledge vacuum in practitioners”. Business Strategy Series, Vol. 13 Issue: 3, pp.128-135.

Davies, W., (2000). “Understanding strategy”. Strategy & Leadership, Vol. 28 Issue: 5, pp.25-30.

First Capital, (2016). Sri Lankan banking Sector. [online] Available at: https://www.firstcapital.lk/wp-content/uploads/2015/06/Sri-Lanka-Banking-Sector-Report-15-06-2016-1.pdf, [Accessed January, 2018].

Gomes, R.C., and Liddle, J., (2009). The Balanced Scorecard as a Performance Management Tool for Third Sector Organizations: the Case of the Arthur Bernardes Foundation, Brazil Curitiba, v. 6, n. 4, art. 5, pp. 354-366.

Haapalainen, V., and Skog, N., (2011). Growth Strategies for Multinational Companies. [online] Available at: https://www.theseus.fi/bitstream/handle/10024/26219/haapalainen_valerie_skog_nan.pdf, [Accessed January, 2018].

Henderson, D., Young, G., and Mittl, R., (2017). Balanced Scorecards: The Integration Point between Enterprise Information and Performance Monitoring. [online] Available at: http://www2.sas.com/proceedings/sugi27/p157-27.pdf, [Accessed January, 2018].

Kaplan, R.S., and Norton, D.P., (1996). Linking the Balanced Scorecard to Strategy. California Management Review, Volume, 36, Number 1, Page 53-79.

Kaplan, R.S., and Norton, D.P., (2007). Using the Balanced Scorecard as a Strategic Management System. Harvard Business Review, Page 2 – 14.

Khomba, J.K., (2011). Perspective Surrounding the Balance Scorecard Model. [online] Available at: https://repository.up.ac.za/bitstream/handle/2263/28706/03chapter3.pdf?sequence=4, [Accessed January, 2018].

Kim, J., Suh, E., and Hwang, H., (2003). A model for evaluating the effectiveness of CRM using the balanced scorecard. Journal of Interactive Marketing, Volume 17, Issue 2, 2003, Pages 5-19.

Kolios, A., and Read, G., (2013). A Political, Economic, Social, Technology, Legal and Environmental (PESTLE) Approach for Risk Identification of the Tidal Industry in the United Kingdom. [online] Available at: http://webcache.googleusercontent.com/search?q=cache:r8XByhlL8p4J:www.mdpi.com/1996-1073/6/10/5023/pdf+&cd=8&hl=en&ct=clnk&gl=lk, [Accessed January, 2018].

Lanka Business Online, (2017). Sri Lanka’s Dialog Axiata introduces mobile payment app. [online] Available at: http://www.lankabusinessonline.com/sri-lankas-dialog-axiata-introduces-mobile-payment-app/, [Accessed January, 2018].

Ceylon Trust Bank, (2016). Annual Report – 2015. [online] Available at: https://www.Ceylontrust.com/pdf/IR/AR/CTB_annual_report_2015.pdf, [Accessed January, 2018].

Niven, P.R., (2014). Balanced Scorecard Evolution: A Dynamic Approach to Strategy Execution. [online] Available at: http://onlinelibrary.wiley.com/book/10.1002/9781118915011, [Accessed January, 2018].

Ogutu, F.M.M., (2015).”Porter’s five competitive forces framework and other factors that influence the choice of response strategies adopted by public universities in Kenya”. International Journal of Educational Management, Vol. 29 Iss 3.

Okcabol, F., (2007). Corporate and Government Accountability for Sustainable Environments: The Balanced Scorecard Approach. In: Cheryl R. Lehman (ed.) Envisioning a New Accountability (Advances in Public Interest Accounting, Volume 13) Emerald Group Publishing Limited, pp.151 – 175.

Parnell, J.A., (2010). “Strategic clarity, business strategy and performance”. Journal of Strategy and Management, Vol. 3 Issue: 4, pp.304-324.

Self, J., and Tolson, D., (2008). Successfully Implementing the Balanced Scorecard. [online] Available at: http://libraryassessment.org/bm~doc/bsc_handouts.pdf, [Accessed January, 2018].

The World Bank, (2017). Sri Lanka; Overview. [online] Available at: http://www.worldbank.org/en/country/srilanka/overview, [Accessed January, 2018].

Trading Economics, (2017). Sri Lanka GDP growth rate. [online] Available at: https://tradingeconomics.com/sri-lanka/gdp-growth, [Accessed January, 2018].

Völpel, S.C., (2002). “Strategic intellectual capital creation: Decontextualizing strategy process research”. Journal of Intellectual Capital, Vol. 3 Issue: 2, pp.118-127.

2 comments