Introduction

HMB has a history with a heritage of over 120 years from the day it first started in a small hamlet called Hotton in the hill country in Sri Lanka where the tea industry blossomed. The Hotton Bank (as it was known at that time) was started by two British Planters, mainly to cater to the flourishing tea industry and over a period of time it has evolved and changed hands to local owners and in 1970 it was incorporated as ABC after a number of acquisitions and mergers. The Bank evolved from a small local bank to one of the largest private sector commercial banks in the country over the years. During the last 30 years, the Bank has grown in stature in terms of not only of the key financial performance indicators, but also touching the lives of people of Sri Lanka economically.

The Bank has a wide network of branches with over 180 branches spread across the country covering all major cities and towns from the North to the South and from the East to the West. The Bank serves, beginning from an infant to a senior citizen and from Micro Entrepreneurs to mega corporate entities. The Bank holds nearly 15% of the market share of the banking business of the country, which has a population of 20 million by serving all segments of the people by offering a variety of financial services from a simple Savings Account to sophisticated needs of high profile investors. The Bank was adjudged the “Best Retail Bank in Sri Lanka” for the year 2008/2009 by Asia Banker based on a variety of criteria of retail banking services it provides to the country.

The Banks’ vision is “to be the acknowledged leader and chosen partner in providing financial solutions through inspired people” and it is with this vision that has been able to create an impact on customers by being their Partner in Progress while the mission of the Bank is “combining the entrepreneur spirit of empowered people with a leading edge technology to constantly exceed shareholder expectations”. Over the years, the Bank has been able to serve customers and create a positive impact by creating value to customers through it’s products of financial services and it’s delivery mechanisms while maintaining the highest levels of regulatory discipline and standards for which, HMB was awarded the “Best Commercial Bank in Sri Lanka ” in 2009 by Euro Money.

Identification the purposes of different types of organizations such as private company, public company, government, voluntary organization, charitable, cooperative

Organizations are set up in different ways to achieve success in the market and remain constant adhering to a flexible structure which suites there business organization. There are many types of business organizations that exist in the market within private sector and the public sector.

Private sector

- Sole trader ship – The purpose of a sole trader is to provide a service or a product to a customer by incurring a value. The business is owned entirely by the owner and the profit or loss is bared by the owner. By becoming a sole trader the owner is not liable to any legal authority which makes the owner to make decisions independently. The benefits of being a sole trader is,

- Easy to commence

- Registration of legalities is not compulsory

- Ability to refrain from paying tax, auditing and maintaining accounts.

- Joint ventures – A joint venture is created when two or more established businesses agree to merge their resources to achieve a particular goal. Moreover, joint ventures are formed for a limited period of time in order to accomplish a specific business goal. Key features of a joint venture,

- Access to new markets and distribution channels.

- Sharing specialized and expertized resources containing Research & Development.

- Clubs and Societies – A club is an association of two or more people together with a common goal of providing service to the community.

Public Sector

- Government departments – These departments are created to provide relief to the public as a service. The departments are located widely across the country in order to provide relief to the low income earners in a country.

- Government cooperation’s – Corporations are revenue generating enterprises that are legally owned by the ruling government.

- Government Companies – The sole intension of government companies is to make investors to invest in the Government companies in order to increase the securities and bonds in the treasury.

Identification the different types of stakeholders and describe the extent to which the HMB meets the objectives of these stakeholders.

A stakeholder is an individual or group that has a real in a company. Stakeholders can be divided into two categories such as internal and external parties in a business. However, both parties can be affected by the actions taking place in a business.

Internal stakeholders are people who work within the business or people who directly influence the business. Moreover, stakeholders are benefited with the followings,

- Employees = Wages and salaries

- Owners = Profits

- Investors = dividends

External stakeholders are people outside the business or people who are not directly influenced with the business but being affected by the actions of the business. The stakeholders involved outside the business are as follows,

- Customer = Value and Satisfaction

- Suppliers = Continuity of purchasing their products

- Creditors = to be repaid on time as per agreed

- Community = employers of the local people

- Government = Tax payments, employ more people, conduct the business ethically and provide reports on the financial conditions of the business.

Responsibilities of the HMB Strategies they are used to fulfill their responsibilities.

The responsibilities of HMB bank,

- Develop innovation on deposits for children, teenagers and adults.

- Increase children well-being by various programs and initiatives which give fun with a purpose.

- Provide Corporate Social Responsibly activities.

- Give customers useful information regarding deposits, Housing loans and other essential information.

- Improve their network and systems around the country.

- Recruit skilled employees and train their existing employees for better performance.

Strategies they are used

HMB bank has given the priority when recruiting the employees and more consider about fluency in English.

Also they have get advices from the World Bank.

They broadcast and provide sponsorships for programs for children and they implement funny programs on world children’s day.

They have implemented many CSR activities such as

- Organizing Shramadana Campaigns.

- Organizing Dharma Deshaun programs.

LO – 02

The Economic System in Sri Lanka attempts to allocate resources effectively.

An economic system is organized way in which a state or nation allocates and apportions goods and services in the national community. Basic means of achieving economic goals that is inherent in the economic structure of a society. Major economic systems are capitalism, socialism and communism. The system of production, distribution and consumption. There are basically four types of economic systems.

- Free economy.

- Mixed economy.

- Command economy.

- Market economy.

The economic system that exists in Sri Lanka is a mixed economic system. We can see the following features in the current economic environment.

- Profit making organizations and the increase of capital would remain I the central driving force behind the economic activity.

- The government would have considerable influence over the economy through fiscal and monetary policies designed to counter economic downturns and capitalism’s tendency toward fiscal crises and unemployment along with playing a role in social welfare interventions.

- Effective Use of resources.

- The extent to which the mix economies as Sri Lanka, for effective allocation of resources between the government and private enterprises varies from countries to countries.

As Sri Lanka. It allocates scare resources among all sectors which the government or private sector and whatever through the budget. As an example the 6% from money is allocated for the education in every year from the budget.

- Government interventions are usually in the form provision or prohibition, subsidies or tax and regulations. For example, public goods are priced low or zero to maximize consumption and increase social benefits. Also the government always try to reduce the tax for public goods. The current tax rate is 15%.

Merit goods are encouraged by subsidies to increase consumption whereas the de merit goods are taxed heavily to reduce social costs. The government has subsidized heavily education of children to ensure the less fortunate are not left or from the main stream.

Impact of the fiscal policy and the Monetary Policy to the business organizations and their activities in the banking industry.

Fiscal policy is the use of government spending to influence the economy. Measures implemented by the government in relation to the collection of revenue and public expenditure are referred to as fiscal policies. These policies can be categorized as expansionary or contractionary while the rest can be identified as advantages and disadvantages of these policies.

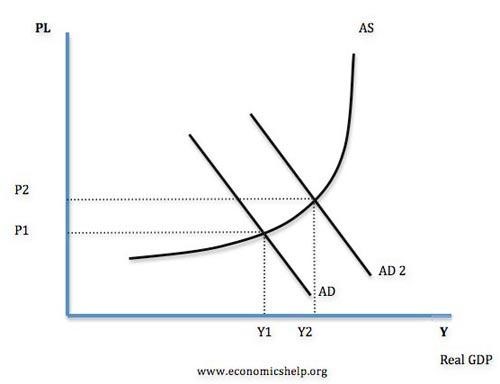

Fiscal policy involves the government in changing tax rates and levels of government spending to influence and aggregate demand in the economy. Expansionary fiscal policy involves government attempt to aggregate demand.

Figure

2

–

Expansionary Fiscal policy

Lower taxes should increase disposable income of consumers influencing to higher levels of consumer spending. This should also increase aggregate demand and could lead to higher economic growth.

Expansionary fiscal policy can also lead to inflation because of higher demand in the economy.

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the money supply, often targeting an inflation rate or interest rate to ensure stability in the currency. The monetary policy supply is cash, credit, cheques and money market. The important of these is credit options which include loans, bonds, mortgages, and other agreements to repay.

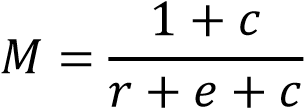

Monetary policy means managing the money and interest rates accordingly without arousing a shake in the economy. We can identify the money supply process by the following equation.

According to the above equation M is the money supply and M B is the monetary base, and m, the money multiplier, is determined as,

These equations reveal that the government can manage the money supply that is by conducting monetary policy in 3 ways,

- By changing the monetary base through open market operations

- By changing the monetary base through interest rate corridor formed by the main policy rates of the bank.

- By changing the money multiplier by changing the required reserve ratio

The impact of competition policy and other regulatory mechanisms on the activities of the selected organization in the banking industry.

Competition policy, on the other hand, generally refers to all laws, government policies and regulations aimed at establish competition and maintain the similar. It includes events intended to promote, advance and make sure competitive market conditions by the removal of control, as well as to restore competitive results of public and private restrictive practices.

HNB is one of leading private bank in the Sri lanka. Banking industry is very challenging and they are competing with each other to get competitive advantage. Competition policy promotes competition and makes markets better and improves the efficiency of various organizations. It ensures wider customer choice, technical innovation which promotes dynamic efficiency and effective interest rates competition between private banks. Competition policies are based on four policies such as antitrust and cartels, market liberalization, state aid control and merger control. Those policies restrict competition including price fixing and other abuse.

Completion policy breaks the monopolistic market and ensures easy entry on new competitors. On the other hand, regulations are enforced by government to forecast how a market works and the outcomes which results for both customers and others in the industry. Some regulations are standard customer service and environmental policies and so on. Regulatory committee monitor rates, ensures standard customer services, surrogates competitors and opening up markets.

LO 03

Market structure in which the banking industry operates and explain how this market structure determines the pricing and output decisions of HMB.

In the market economy the partakers in various markets are either price makers or price takers. Price makers are who decide to set the price that exists in the market, while price takers are who remain silent in the market in which the price is being dominated by the price makers.

Markets are simply known as the place where buyers and sellers meet in order to exchange a specific good or service for agreed price between both. In economics markets are categorized according to the size of the business, the number of sellers of specific goods and services, their share of the market and the degree of competition. There are main four markets in economics which are broadly identified as four market models which are discussed below.

- Perfect competition

- Pure monopoly

- Monopolistic competition

- Oligopoly

Perfect competition

Perfect competition is meant by economists as where the competition is high at its possible level. Accordingly, this is and industry configuration in which there are many firms producing homogenous (same) products. The following characteristics are said to display perfect competition,

- Large number of buyers and sellers.

- Homogeneous products are produced by all the firms in the market.

- Free entry to the market as well as exit.

- No advertising cost needed.

- Consumers indulge in rational decision making. Since the consumers are well aware of the changes in the market.

- No government intervention

- No long term economic profits.

Therefore, Single firms‟ activities cannot influence pricing on products and services. Pricing is also transparent so that the consumers are also well aware of different type of costs between sellers.

Pure monopoly

A pure monopoly exists when there are no competitors in the market and there’s no similar alternative in the market to compete with the product or service. Monopolies are considered by tough barriers to entry.in this economic module the firm is the only price maker and decider for the goods and services produced. This includes the following,

- High costs

- Copyright or patents

- Government regulations or barriers

- Tariffs

- Granting of various contracts for nationalized industries.

The demand for monopolistic completion is elastic due to the existence of similar substitutes in the market. Due to that reason competition is influenced in the market and deems to be competitive in selling a product. Monopolistic competition is the base where competition occurs. In record most competitions take place when there are sufficient competitors with various products with different features.

Many small businesses practice under monopolistic competition, including businesses owned independently and high-street stores. The motive of all business is to target the customers and gain maximum profit. But in this scenario maximum profits are a real challenge due to the existence of the market competition. To gain profits in these particular market businesses should make unique offers to which the customers should possess interest towards the product.

Monopolistic competition refers to a market situation in which there are large numbers of firms which similar products with differentiated features. The following are some characteristics of market competition,

- Large number of sellers.

- Product differentiation

- Freedom of entry and exit

An oligopoly is where the market is being dominated by few companies, each of which has control over the market. Furthermore, oligopoly is defined well when the market is considered by its behavior than its market structure. The market is defined by a mechanism called “the concentration ratio” which means, if a large percentage of the sales are being recorded by 4 largest firms, then its called oligopoly. The following are characteristics of oligopoly,

- Few sellers

- Homogeneous or differentiated products

- Interdependence

- Importance of Advertising and Selling costs

The market structure which the banking industry operates.

Banking has become an oligopoly instead of a competitive business. Banking is not really a competitive .In really it’s more like an oligopoly. Oligopoly is in which an industry is controlled by a small number of firms. An oligopoly is a lot like a monopoly where one firm controls the whole show.An oligopoly industry produces either a homogeneous product or heterogeneous products. Therefore we can see the products are same in the banking industry like savings accounts, fixed deposits and etc.

But the banking industry operates in a different universe. Charges for products and services and the cost of those products and servicesoften have very little relation to each other. In Sri Lanka there are several banks in industry like Peoples’ Bank, BOC, Sampath, Commercial, and DFCC and so on. Therefore one bank is introducing something to the market so others are react to that. Also those are governed by the Central Bank on behalf of the government.

How the market structure determines the pricing decisions.

The banking industry is in an oligopoly structure. There are only few firms in the market. Thus the price in an oligopoly structure determines as below. The firms are competing in the market with not differecial products with differential price. If one bank increases its interest rate for savings deposits, its rivals will not follow it and change their interest rates. On the other hand it happens same.

As an example the interest rate for savings in NDB Bank is increasing up to 12% then others in the market they also try change their interest rate as accordance compete with the NDB Bank.

Market forces and organizational responses in the banking industry.

This is evaluated in accordance with the Porter’s five factors.

| Market Forces | Organizational response |

| Threats of new entrances | The banking industry deals with other peoples’ money and financial information new banks find it difficult to startup. Due to the nature of the industry. People are more willing to place their trust in big name, well known, major banks who they consider to be trustworthy. The banking industry has undergone a consolidation in which major banks seeks to serve all of a customer’s financial needs under their roof. Thus consolidation furthers the role of trust as a barrier to entry for new banks looking to compete with major banks. While it is nearly impossible for new banks to enter the industry. |

| Powers of suppliers | Capital is the primary resource on any bank and there are four major suppliers capital in the industry such as customer deposits, mortgage and loans, mortgage-backed securities and loans from other financial institutions. By utilizing these four major suppliers, the bank can be sure that they have the necessary resources required to service their customers’ borrowing needs while maintaining enough capital to meet withdrawal expectations. The power of the suppliers is largely based on the market, their power is often considered to fluctuate between medium to high. |

| Powers of buyers | If a person has one bank that services their banking needs, mortgage, savings, checking etc. It can be a huge hassle for that person to switch to another. To try and convenience customers to switch to their bank they will often times lower the price of switching through most people still prefer to stick with their current bank. The internet has greatly increased the power of customer in the banking industry. Therefore banks are always try to retain their existing customers. |

| Availability of substitutes. | Some of the banking industry’s largest treats f substitution are not from rival banks but from non-financial competitors. The industry does not suffer any real threat of substitution as far as deposits or withdrawals, however insurances, mutual funds and fixed income securities are some of the many banking services that are also offered by non-banking companies. Often times these non-banking companies offer a lower interest rates on payments then the consumer would otherwise get from a traditional bank loan. Therefore banks consider their substitutes and make updates with the technology. |

| Competitive Rivalry | The banking industry is highly competitive. Because of this banks must attempt to sure customers away from competitor banks. They do this offering lower financing, higher rates, investment services and greater conveniences than their rivals. The banking competition is often a race to determine which bank can offer both the best and fastest services. But has caused banks to experience a lower return on assets. Major banks tend to prefer to acquire or merge with other banks than to spend money marketing and advertising as a respond. |

Business and cultural environment in Sri Lanka shapes the behavior of the HMB

Business environment is divided in to Business and Environment. So Business means human activities like purchase, sales of products and services, production, distribution and so on. Also Environment means factors of surroundings.Busiess environment is the set of political, economic, legal, cultural or social that is uncontrollable and affects the functions of the organization. Business environment includes two components such as internal environment and external environment.

Business Environment

Internal factors External factors

- Customers – Socio- Cultural factors

- Suppliers – Economic factors

- Potential investors – Political factors

- Competitors – Legal factors

- – Technological factors

HMB is operating more than 25 branches in Sri Lanka. It is operating only in Sri Lanka.Their operations largely depends on the business and cultural environment of the divisions they operate. Economic environment is not same for areas around the country. The capital income of Colombo and Jaffna are not same. Also the living expenditure is not same in those Districts.

But Economic policies like fiscal policy, monetary policy and other regulatory mechanisms are same in the country.

Social environment of business includes social factors like life expectancy rate, literacy, poverty, beliefs, values, traditions and customs. The culture of Jaffna is Hindu.

Political environment includes the political system, the government policies and attitude towards the business community and unionism. All these aspects have a bearing on the strategies adopted by the bank. The stability of the government also influences business and related activities to a great extent. Legal environment refers to set of laws, regulations which influence the bank and its operations.

Technological environment includes the methods, techniques and approaches adopted for the activities of the bank. The bank always update their systems with the new technology. Hence we can evaluate the business environment around the bank.

Legal factors are of great importance since these are the first barrier that advertising needs to cross in terms to reach its target audience. Legal clearance in other words ensures that the advert is based on principles of ethical conduct and highlights rules and regulations regarding ethical decision making.

Conclusion

Organizations are categorized in two groups as public sector and private sector. Private sector consists of sole traders, partnerships and limited companies, while public sector involves in government departments, corporations and companies. According to the categories the motives of each organization defer as profitable and non-profitable organizations. The motive of private sectors is to gain profit and remain sustained in the business market. Whereas, public sectors sole motive is to provide services and reliefs to the public (citizens in the country).

An economy is a mechanism that a country practices to allocate resources that are available in the country, and the price makers for specific goods in different market modules. The economy is responsible for the goods produced and the way that the goods are being produced.

Government regulations and conditions are being imposed to the organizations in order to restrict businesses from malpractices.

A countries income is based on the taxation that a government imposes on all types of operations that takes place in the market. Government uses the economic policies such as fiscal and monetary policy to maintain stability in the economy and maintains mechanisms to safeguard the country falling in to inflation.

References

- Our company ^ http://www.btplc.com/Thegroup/Ourcompany/index.html Retrieved 08th June 2015

- Our history ^ http://www.btplc.com/Thegroup/BTsHistory/index.htm Retrieved 08th June 2015

- Louis Putterman, Brown University, Markets Vs. Controls

^http://www.econ.brown.edu/fac/Louis_Putterman/courses/ec151/Chapter_05.pdf Retrieved 26th June 2015

- Impact of expansionary fiscal policy ^ http://www.economicshelp.org/blog/617/economics/impact–ofexpansionary–fiscal–policy /

Retrieved 26th June 2015

- Group income statement HNB^ file:///C:/Users/DELL/Documents/2015_BT_Annual_Report.pdf Retrieved 26th June 2015

- Share price summary ^ http://btplc.com/Sharesandperformance/Sharepricegraphs/Sharepricesummary/index.cfm Retrieved 26th June 2015

- Interdependent pricing ^ http://www.slideshare.net/RajatSharma34/pricedeterminedunderoligopoly Retrieved 05th July 2015

- Oligopoly market ^ http://www.slideshare.net/RajatSharma34/pricedeterminedunderoligopoly Retrieved on 05th July 2015

- Agreement of ofcom ^https://en.wikipedia.org/wiki/Openreach Retrieved on 06th July 2015

- Agreement of ECI ^http://www.ynetnews.com/articles/0,7340,L–3916285,00.html Retrieved on 06th of July 2015

- Concentration ratio ^http://www.economicsonline.co.uk/Business_economics/Telecoms.html Retrieved on 06th of July 2015

- Technology and recognition ^http://www.btplc.com/Innovation/innovationNews/index.htm Retrieved on 06th of July 2015

- What is EMU? ^ https://en.wikipedia.org/wiki/Economic_and_Monetary_Union_of_the_European_Union Retrieved on 12th of July 2015

3 comments