Part 1: Topic, Company Introduction & Overall Approach

1.1 Discussion background

Companies in the telecommunication industry are faced with several challenges; technology continuously change at a rapid pace and they are compelled to upgrade the infrastructure to cater to these specific needs. Further, the telecommunication companies should be prepared, to service the increased demand for various voice, data and video-based facilities continuously. Moreover, internal competition is high and therefore the companies are obliged to maintain their technology leadership well ahead of the other players in the market. Resultantly, Telecommunication companies require to overcome these challenges. The paper evaluates two of the top telecommunication companies based in the United States (US); namely, AT&T (T) and Verizon (VZ) to understand how they performed in these competitive market spaces.

1.2 Telecommunication sector in US

By the third quarter in 2017, the telecommunication service providers had lost approximately 0.73% market; this indicates that the industry was faced with a challenge to grow in an environment that currently experienced an over-supply. Whilst, the 4th generation (4G) and 3rd Generation (3G) services marketspace were highly saturated, the conventional voice and message-based services were on a downhill trend in profitability. However, data communication as well as internet protocol TV (IPTV) streaming continued to gain traction. Another major network overhaul that was experienced was the introduction of the 5th generation (5G) services during period 2018 – 2020 (Zacks Equity Research, 2018). These are some of the conditions in which the companies were compelled to operate.

Meanwhile, the financial backing of the telecommunication companies remains important, due to the continuous investments required to upgrade the systems. For instance, they are required to continuously upgrade their networks, to provide high-end services to the customers consistent with the current trends. The margins are high in such high-end service spaces. The selected two companies represent the selected two players. T and VZ are the largest players in the telecommunication services market in the US. T has generated a revenue of US$163.79billion in 2016 in comparison with V’s US$125.09billion for the same period (Statista, 2018). Meanwhile, VZ is seeking to maintain a technology edge over others and introduce limited 5G services in 2018 while T and most other players are adopting a “wait and see” approach towards encompassing the next major industrial change.

1.3 Justifications for the topic

Technology changes which occur in the United States will eventually impact global standards; the US is on the verge of rolling out next generation data services within the next few years and this will contribute to an even bigger industrial change than the 4G rollout which took place almost a decade ago. The companies are preparing for this major change by seeking to develop their competitive advantage to meet these changes. However, the telecommunication market and generation changes highlight the need for major investments to incorporate the capabilities of the current networks and meet the future needs. Changing of 4G network to deploy 5G technology is challenging. However, this initiation will improve the overall network related capabilities and drive results accordingly. Moreover, the financial strength of the telecommunication companies and the operating indicators are of paramount importance to meet this challenge.

As mentioned earlier, the overall success levels of this technology deployment would lead to positive effects in the future. The success of the 5G implementation will lead to the technology being accepted and established at a global scale. While US markets do not represent technology leadership in the current global context, they remain the largest market for new services to be deployed and could contribute positively towards global deployment of these new services and development of the required standards and protocols. Thus, the role played by the two largest players in the US markets remain vital, to introduce these industry changes.

1.4 Project objectives

Meanwhile, to ensure the overall success of the project; a clear set of objectives and research questions require to be defined, for which the program envisages to identify solutions. The following project objectives will provide the guidelines that are important, to ensure the program remains focused and achieve appropriate results.

- To ascertain the industry changes taking place in the telecommunications industry in the US.

- To evaluate operating and financial results of AT&T and understand the overall financial strength of the company

- To evaluate operating and financial results of Verizon Telecommunications and understand the overall financial strength of the company

- To identify which of these companies are suitably placed to meet the future industry challenges

Therefore, to meet the above project objectives, the relevant research questions require to be formulated. The following are the research questions that are involved with the study context.

- What are the changes that are prominent in the context of the telecommunications industry in the United States?

- To which extent does AT&T possess the financial and operational strength to meet these changes?

- To which extent does Verizon Telecommunications possess the financial and operational strength to meet these challenges?

1.5 Study approach

Meanwhile, to evaluate the performance of the telecommunications sector in the United States and the details associated with these companies, the research is compelled to rely on secondary information. There are considerable details regarding the industry and industry performance benchmarks. This will make it easier for the performance of the companies to be evaluated. It is important to note that these are the two largest players in the United States and they are expected to perform substantially, reaching above the industry norms.

The company performance details can be sourced from the financial statements they file (Form 10-K) as well as other related documents. There are opinions regarding these companies including the industry which are also available. Such details are beneficial for evaluating these companies and the industry in terms of their future potential. This data will include details regarding the company, both operational as well as financial trends and identify whether they will be able to continue to face the challenges of the industry in the future. Thus, the above steps will lead the parties to achieve positive results and eventually benefit from the outcomes.

Part 2 – Information gathering and accounting techniques

2.1 Background

The information for the study requires to be gathered from appropriate sources. For instance, selection of the appropriate sources will ensure the details of the study can be compiled in a suitable context. It Is further important to ensure that the information thus collected require to be evaluated in an appropriate manner. For this purpose, the appropriate research and accounting evaluation techniques need to be incorporated. Such an approach will provide useful insights to the telecommunications industry of the United States (US) and how the two companies perform consistent with the needs of the industry.

The study is focused on the performance of the companies Verizon (V) and AT&T (T); since both these companies represent the two largest telecommunication providers in the United States. The study will evaluate the performance of these companies and compare with overall industry performance. This will indicate the key areas these companies require to concentrate, to improve performance. Having increased financial strength for these companies will enable them to perform and introduce several new services to the market in the future. Such introductions will empower them to maximize the benefits to the parties and ensure that they reach appropriate results consistent with market needs.

2.2 Sources of information

The study is obliged to rely on secondary sources of information; they will provide appropriate insights to the industry as well as company performance. The main purpose encompasses the evaluation of trends that has occurred over the past three years (Calvert, 2013). This will indicate how the future changes are likely to take place and whether these companies are ready to face such changes. Meanwhile, to ensure that appropriate insights are formulated, the correct sources of information require to be developed. Therefore, due to lack of primary information sources, one needs to ensure that the secondary information sources are reliable (Fourie, 2014).

Industry reports – there are various industry related reports that could be found; thus, when information is being gathered relevant information regarding the industry needs to be identified. For instance, the industry reports will indicate the changes that are taking place in the industry and how these insights can be related to appropriate outcomes subsequently. Therefore, details regarding the industry will thus be important to identify the role the companies require to play, to position them competitively.

Finance sites – Yahoo Finance as well as Google Finance consist of two platforms that will provide details regarding the companies and the industry. This will allow the comparison of performance criteria of these companies with overall industry related outcomes. Further, the nature of competition as well as details of competitor performance could be identified in this context. Thus, the role of the financial sites and the information they provide remains of paramount importance for the evaluation of the findings and formulating of insights related to these areas.

Annual reports – Both the companies file 10-K reports with the Securities and Exchange Commission in the United States; this indicates that accurate insights regarding the performance of these companies and related outcomes are available for evaluation. Resultantly, comparison of the performance of the companies in the operating as well as financial grounds has become relatively easier. Therefore, these areas require to be identified in the study context and insights need to be developed consistent with the outcomes expected in the future.

2.3 Methods used in information collection

To compile a study, primary as well as secondary information could be collected. Primary information is information which is collected for the requirements of the study directly. This in other words indicate that the information collected remains consistent with the needs of the study specifically and meet relevant expectations in terms of study objectives. Further, there is the ability to collect the secondary information for the study. Such information areas are already collected and they could be processed in conformance to specific study requirements. Thus, primary as well as secondary information areas remain vital for the parties to identify the main study aspects and develop an appropriate understanding.

In this instance, the primary focus encompasses published information regarding the industry and the companies in consideration. The access to these companies is only via published information. Further, both companies are listed companies and this indicates that information regarding these companies are available to the public. There are annual reports as well as details concerning company publications that could be used to evaluate the performance of these companies and ensure appropriate information regarding the study are collected related to the expectations.

The appropriate method to collect relevant information in this instance, is the use of the internet; since all required information concerning the industry and the companies are available on the Internet in electronic form. Thus, the information required for the study can be collected from the internet. This is useful since several sites are free and the information is publicly available for the study. Thus, information can be appropriately downloaded as required.

The previous section of the study has identified the main areas of information that require to be collected. The first step of this exercise is to identify the locations that contain such information. Thereafter, the information available needs to be identified, and appropriate steps taken to extract the necessary data for the study. Thus, the information that are collected in this context remains important and they should provide appropriate insights concerning the areas in detail. The information areas are linked with the industry as well as the companies in consideration, therefore, they need to be related to the objectives of the study.

Once the required information is collected, it requires to be processed for analysis. Relevant analysis techniques are required to be improvised, to ensure that the insights are related to study requirements. It is important to note that due to the heavy dependence on secondary information, the actual information collected remains accurate by nature. However, the main challenge in this context is to collect comparable information regarding both the companies and the industry.

2.4 Techniques used in information analysis

Once the information is collected, the data requires to be analyzed using appropriate analysis tools. Meanwhile, if primary information is to be collected, there are several techniques that could be used for analysis depending on the exact requirements of the study (Morris, 2006). However, in this instance, the study is heavily dependent on secondary information and therefore, several limitations are likely to exist, when information analysis is considered. Resultantly, the available information in the current context may not be appropriate for the purpose. However, in this instance, the study tends to rely on secondary information (Cossham, 2014).

The business-related information is collected from company sources as well as industry sources; the discussion uses Porter’s five forces model to evaluate the industry pressure the company encounters. It is important to evaluate the company capabilities afterwards and for this purpose, the study endeavors to conduct a SWOT analysis for each company, based on the findings of the business and financial aspects. This will facilitate improved provision of the recommendations for the study areas related.

On the other hand, the study needs to also collect information from annual reports. These are primarily the details regarding company financials and performance aspects. The insights associated with the financial reports will enable the evaluation of company financial performance details. Likewise, to compare financial details, the study will have to use a ratio analysis approach. This will enable the company performance of several areas to be established and compared. Ratio analysis will allow understanding of the overall financial performance of the company on a comparable basis.

It is also important to ensure that the information related to the study area remains consistent with the needs of the study and the insights are likely to be useful by nature. While the analysis of the secondary information remains a challenge, adopting appropriate methods for analysis of the information will be able to ensure that the required insights are formulated regarding this area of discussion. It is likely that such insights remain considerably useful for purposes of the study, and ensure the position of these two companies within the telecommunication services industry of the US can be clearly identified.

2.5 Ratio analysis framework

Meanwhile, to identify and compare the financial performance of the two companies, certain ratios require to be calculated and they are as follows:

- Profitability ratios – these ratios would indicate the nature of the profitability of the company. For instance, calculation of gross profits and net profits remain important and would ensure as to eventually whether adequate returns, are generated by the company to attract more investors in the future (Lahdenperä and Koppinen, 2009).

- Liquidity – the companies need to ensure that they possess the required liquidity resources to meet daily cash needs. Thus, maintaining required levels of liquidity remain vital for the parties. The liquidity is important for the short-term survival of the company.

- Capital structure – this shows the level of debt the company is committed in the long term and how these debt aspects would impact the overall operations of the company. Meanwhile, management of debt remains an area of importance for the parties, as the equity levels require to be balanced with existing debt to ensure that appropriate results are reached (Calandro, 2010).

- Working capital management – the companies need to manage inventories; ie. accounts receivable as well as accounts payable in an appropriate manner. This will ensure that the companies will formulate an appropriate set of insights concerning the efficiencies they create on the cash conversion cycle.

Thus, the above areas indicate that they will be able to manage these key areas consistent with the needs they achieve which are supported by results thereof.

2.6 Limitations

One of the main limitations associated with the study is the significant reliance on secondary information; this could make the details related to both companies significantly difficult to compare.

Another issue associated with the usage of secondary information being that they are specifically not collected in relation to the study; this also could create a mismatch between the needs of the study and the information collected.

Meanwhile, the business analysis frameworks that have been used in this instance contain several weaknesses, that of being highly subjective and limited in scope. Thus, a business analysis requires to be undertaken, based on the objective findings to mitigate these weaknesses.

Another aspect of the study being it is dependent on ratio analysis and the ratios are likely to possess inherent drawbacks in each instance. This is another issue that prevent users from reaching accurate results thereof.

2.7 Conclusion

Thus, the above discussion associated with the methods adopted by the study convey that it is primarily reliant on secondary information. This is appropriate as the companies in consideration do not have any presence in the Sri Lankan market. However, the future activities of the companies will impact the global telecommunications sector in the long term. Therefore, the study could use appropriate information areas consistent with the needs and expectations of the parties to reach relevant conclusions.

Part 3 – Analysis and conclusions

3.1 Background

The companies need to ensure they remain competitive and guarantee they continue to provide the customers with the required services. The industry requirements are such that continuous capital infusions are required by these companies. However, if the companies are incapable of maintaining the capital investments, they might not be able to improve the overall telecommunications infrastructure. This indicates that the nature of the services required by the parties may not be fully compensated by these players in the market and naturally they will be unable to reach desired results in the future.

3.2 Telecommunication services in US

3.2.1. Telecommunications industry performance

The global telecommunication industry in the current context is highly saturated; since there are various global and regional service providers and the expansion possibilities are limited. Meanwhile, several developed as well as emerging markets have encountered mobile services reaching over 100% of the population which highlights that a single user owns more than one mobile connection in place (Schatz, 2014). However, in the United States, the statistics are lower and record approximately 82% currently.

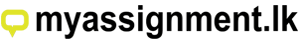

Figure 3.1 Mobile penetration rates in US (Statista, 2018)

The above chart indicates that the actual growth of the mobile penetration levels in the US has been extremely slow and is estimated to remain sluggish in the future as well; only a 700-basis point growth is envisaged within the next three years.

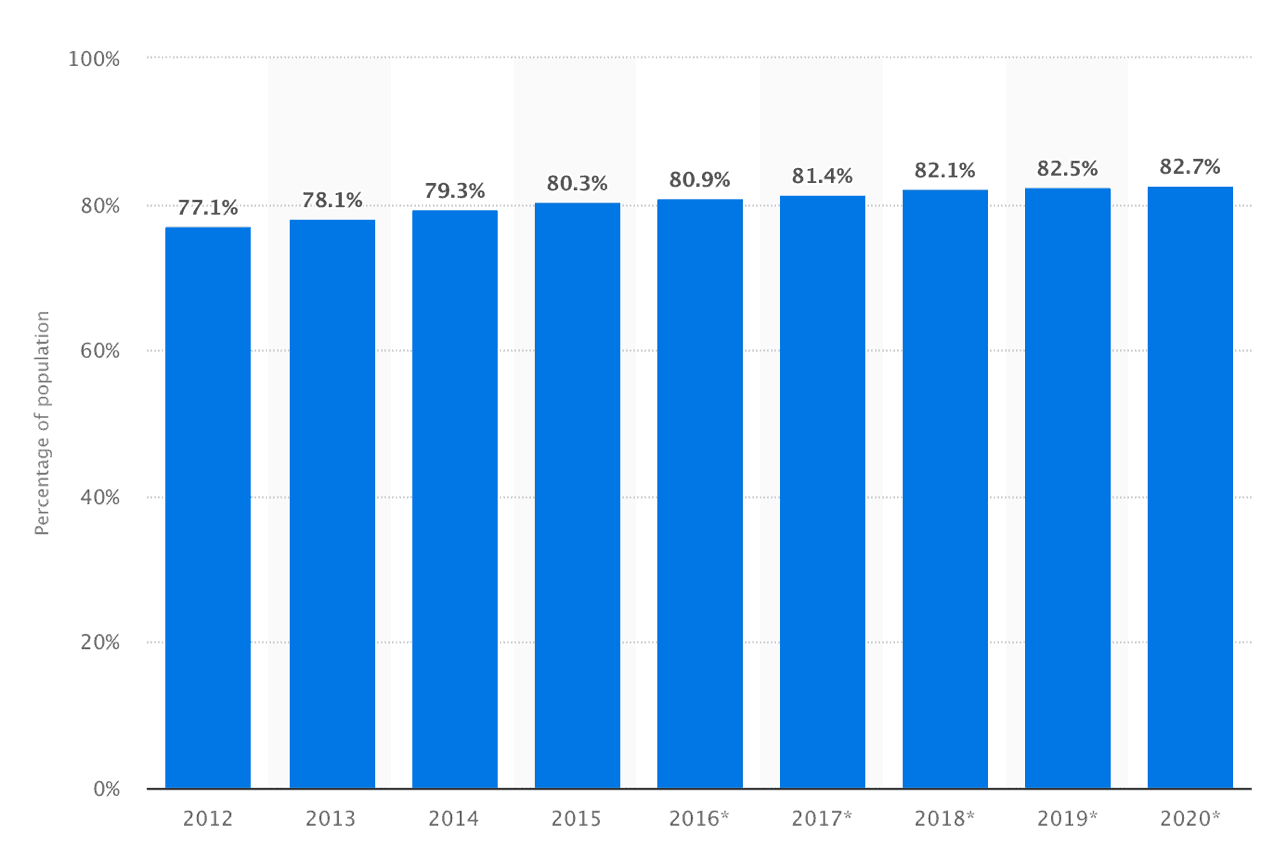

Figure 3.2 Global market telecommunication services growth (Strategy&, 2017)

When one observes the indicators of the above chart, it is apparent that the US is also following similar global trends; since the industry has reached a point of technology change. The current technology is primarily based on 4G services (mobile) while the future is based on 5G service requirements. However, it is important to note that the slowdown of the industry will eventually be attributed to the slowdown of conventional services such as the voice communication (Gautam, Sing and Sharma, 2014). However, it is important to note, that the actual demand for data is not slowing down.

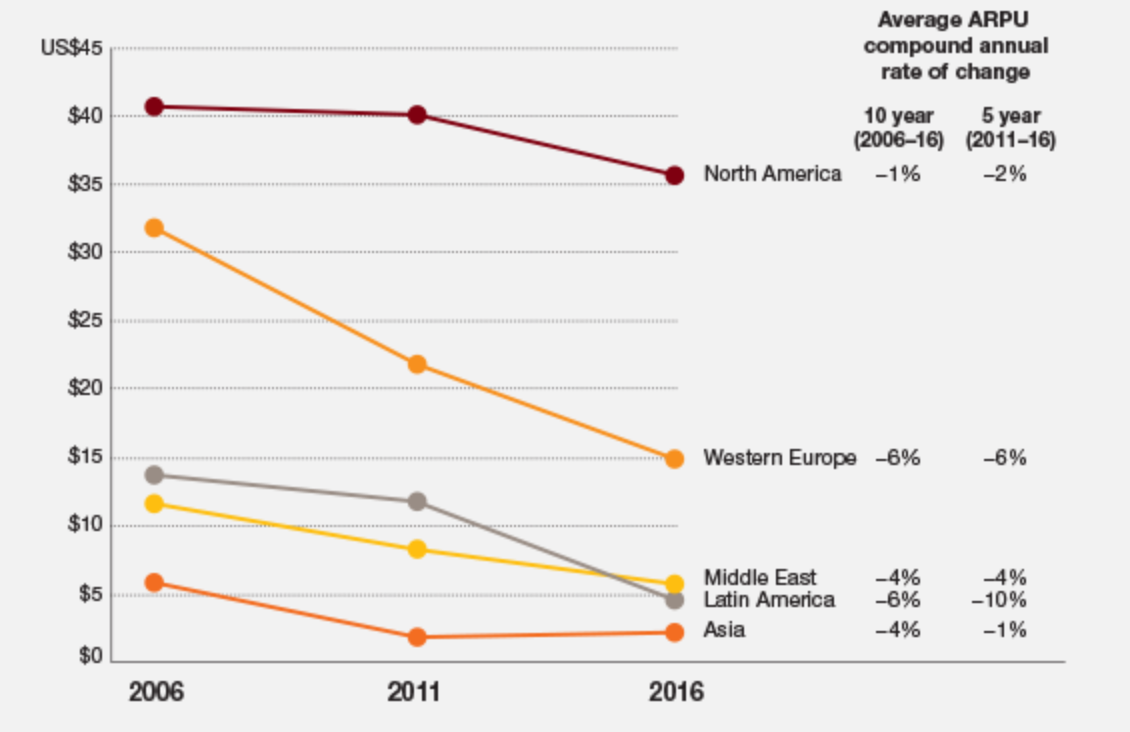

Figure 3.3 North American demand for data communications (Sawanobori and Roche, 2015)

The above chart depicts that not only the demand for data communication continues to be active, but it is in fact accelerating on the front of the growth. Thus, mobile data traffic is likely to continue to grow and ensure they achieve maximum benefits thereof. BI Intelligence (2017) states that the global growth for data demand will be comprehensive where the increase is likely to be around sevenfold due to increased penetration of smartphones. Thus, the demand growth for data will continue to be experienced in the United States as well as at a global level.

While Gartenberg (2017) is of the view that the introduction of 5G is a few years away at consumer level, since several infra-structural changes are taking place. Meanwhile, it can be observed that in the United States, Verizon has taken the lead in launching limited facilities of 5G services in eleven cities across the country. Therefore, it is significantly clear that the need for data communication related improvements requires to be underway in the industry and the deployment cycle for a total new industry aspect is considerably closer.

3.2.2. Industry pressure analysis

To evaluate the industry pressure, the companies are faced with in the US markets, Porter’s five forces analysis could be undertaken. The following table indicates the Porter’s analysis elements.

| Impact | Details | |

| Bargaining power of the customers | Medium | The customers can select an appropriate service provider; however, depending on the needs of infrastructure investments required by the company, the number of service providers are limited. |

| Bargaining power of the suppliers | Low | The service providers are considerably large companies and they directly connect with the clients. On the other hand, the suppliers are highly segmented and therefore possess minimal ability to influence these companies. |

| Threats from new entrants | Low | This is a highly regulated industry and infrastructure investments required to provide these services indicate that any threats from new entrants are considerably low |

| Threats from substitutes | Low | There are hardly any substitutes for these services and while there could be certain substitutes, they are limited in scope or demand a very high price point. |

| Internal competition | High | The players within the market space are compelled to face a very high level of competition amongst each other. This is an area of importance that they need to consider, |

Table 3.1 Porter’s five forces analysis (author developed)

Thus, the above analysis highlights that the industry is attractive provided that the company is well positioned within the telecommunications market. Both these companies under consideration are well positioned players within this competitive market.

3.3 Evaluating the company performance

This is the landscape in which the performance of the companies requires to be evaluated. Currently, T remains the largest telecommunications company in the US. The company has generated a revenue of US$ 160.55Billion in 2017 in comparison with USE$163.79Billion in 2016. Further, it can be identified that V has earned a revenue of US$ 126.03billion in 2017 as opposed to US$125.98Billion in 2016 (Deloitte, 2016). This places the company as the second largest player in this large and highly competitive market place. Thus, the comparison of the performance of the largest and the second largest telecommunications companies in the United States should indicate, which company is meeting the required targets in terms of financial performance.

3.3.1. Average revenue per user

This is one of the most important indicators regarding the performance of a telecommunication company in a business content; the level of revenue generated on average per user indicates the nature of the market that the company is catering to. The following chart indicates the ARPU for both companies. On average, ARPU in US was US$42.92 in 2015 (Statista, 2017). Meanwhile, VZ has reported a postpaid ARPU of US$136.98 in 2017 in comparison to US$58.09 reported by T over the same period. However, both companies have experienced a drop in ARPU over the period and this is driven by price competition in the market (Nasdaq, 2018). Price competition has become a part of the total industry outlook due to the high level of industry saturation currently being experienced.

3.3.2. Revenue growth

This highlights how the companies have observed growth in revenue over the past few years. It is important for the telecommunications companies to experience a continuous growth in the revenue trends since such progress will contribute towards the companies gaining benefits of scale, in the future. The following chart indicates the revenue growth details associated with this instance.

Figure 3.4 Revenue and growth (AT&T and Verizon Communications Annual Reports, 2018)

The above chart depicts that both companies have experienced different revenue growth patterns; V has experienced a revenue decline from 2015 to 2016 whilst being almost flat in 2017. This is consistent with the industry’s minimum growth rates in place. However, AT&T has experienced a revenue decline in 2017 after seeing modest growth in the previous years. This highlights that both companies faced a slowdown in revenue growth trends and the companies need to ensure that they resolve this issue effectively. Meanwhile, the companies should prepare themselves for the next growth opportunity that is likely to materialize.

3.3.3. Profit margins

Profitability of the company is one of the main indicators which displays the level of success of the companies. Higher the profitability, higher the attractiveness of the business to the investors. Thus, the investors are willing to invest more in the businesses that remain considerably profitable. This highlights that the companies are focused on maintaining the profitability levels of the company. The following chart indicates the overall net profitability levels of the operations and the affiliated results thereof.

Figure 3.5 Net profit margins of the companies (AT&T and Verizon Communications Annual Reports, 2018)

Both companies have experienced an increase in net profits of the company which has further increased in 2017 in comparison with 2016; meanwhile, they have also observed that between 2015 and 2016, the companies have observed the profit margins to remain constant. This confirms that despite the stagnant revenues, the companies have been able to increase the overall revenue levels. This is a positive sign for the companies. The gross margins of the company are likely to indicate as to how profitability remained after accounting for direct expenses associated with the services provision. The details are as follows:

Figure 3.6 Gross profit margins of the companies (AT&T and Verizon Communications Annual Reports, 2018)

The above chart depicts that company VZ has been maintaining a higher level of gross profits in comparison with T. However, it can also be observed that the gross profit of both companies, have declined over the past three years. This is attributed to the almost flat or declining sales revenue. Therefore, owing to the decline in revenue, the operating leverage of the company has also declined, resulting in the overall profitability of the companies being low.

Thus, the above profit margins in the case discussed above, depicts that with industry saturation, the overall profit margin saturation has also kicked in. Therefore, the company needs to be highly attentive regarding this nature of behavior associated with the company. This is owing to lower profits impacting the overall long-term return generation capabilities. The cost of the restructuring drive of the companies based on the changes to industry conditions have resulted in the net profits of the companies increasing.

3.3.4. Return generating capabilities

The companies need to generate returns for the shareholders; further, all parties who would have invested in the company in terms of equity as well as debt would expect the company to invest in these activities and maximize the return generating capabilities in the future.

Figure 3.7 Return generating capabilities of the companies (AT&T and Verizon Communications Annual Reports, 2018)

VZ has a higher return generating capability in terms of returns on assets when compared with T; recording 11.71% in 2017 in comparison to 6.63%. Thus, the overall return generating capability on assets in place are likely to be high in VZ and would be considered more attractive to the customers. However, as observed in 2017, this has increased since both companies have taken short term cost restructuring measures. The companies however, need to evaluate the improvements in revenue with a view to increasing their return generating capabilities in the future. The company will experience higher levels of strength associated with these capabilities in place. Therefore, it is important to identify how companies can generate returns for the shareholders. Thus, the return on equity values can be indicated as follows:

Figure 3.8 Return on equity values (AT&T and Verizon Communications Annual Reports, 2018)

The above chart depicts that VZ has been able to generate very high returns for the equity holders. The company has a very low level of equity and they have been able to generate net profits that are very attractive to the equity base. Thus, the returns they generate remains well above market rates. However, it is also important to note that T would generate returns more in par with the market rates and remain rational.

3.3.4. Liquidity position

This should indicate the ability of the company to meet the short-term debts they have incurred. the company should in theory possess sufficient short-term assets to meet the expected short-term debts. However, they need to ensure that they evaluate these issues and provide for appropriate short-term assets, to strengthen the short-term debt position of the company in the future. Meanwhile, the level of liquidity remains vital for the company to achieve the required results. The following chart highlights the current ratio.

Figure 3.9 Liquidity position of the company (AT&T and Verizon Communications Annual Reports, 2018)

The chart indicates that the current ratio of both the companies have dropped considerably over the past three year period. A current ratio above 1.00 indicates that the company has the required capability to meet the demands in terms of the current liabilities with the current assets they possess. In 2017, both companies have current ratios just below 1.00. While T has been experiencing lower than 1.00 current ratios continuously, it is also important to note that VZ has also experienced such ratios in 2015, 2016 and 2017. This in theoretical context highlight the fact that the companies will not be able to meet the demands in terms of short-term liabilities they have acquired.

3.3.5. Working capital management

The working capital management aspects in general include the inventory management, receivable management, payables as well as the asset turnover levels. Therefore, it is important to note that with the telecommunications services providing companies, the role of the inventory is low.

3.3.5.1. Receivables turnover

This indicates the efficiencies and the collection capabilities of the company. The company once they issue a bill, needs to collect the dues within a certain period. Meanwhile, the period that they are taking into consideration requires to be appropriate for the purpose. The company needs to ensure that they maintain an efficient system to collect the dues, and ensure that they receive sufficient funds to meet their commitments in liabilities.

Figure 3.10 Days sales outstanding (AT&T and Verizon Communications Annual Reports, 2018)

The above chart depicts that until 2015, both the companies maintained consistent collection periods; these periods were approximately 40 days. However, this changed from 2016 onwards and VZ has experienced the highest increase which is closer to 70 days. T on the other hand has been able to maintain a consistent rate. Thus, VZ requires to pay attention to this aspect, and ensure that they maintain a reasonable collection period to guarantee that the cash flow strains are appropriate and manageable for them in the future.

3.3.5.2. Payables turnover

It is often considered that longer the company can take to settle payment, it is better. However, this does not reflect the actual implications; for instance, if the company intends to develop long term relationships with the suppliers and if the latter is of the view that the company takes too long to settle payment, it is likely that they will refuse to work with such companies in the future. The following chart thus indicates the actual position associated with the payables of the company.

Figure 3.11 Payable turnover (AT&T and Verizon communications Annual Reports, 2018)

The above chart indicates that the overall payable levels associated with the company has been increasing in the case of T. The payable periods have reached over 80 days and this means the company might take approximately four months to settle the suppliers on average. This might impact the relationships they have established with the suppliers negatively. Therefore, it is vital that the company work towards reducing this gap and ensure they settle the dues to the suppliers on a timely basis. Further, VZ has been able to maintain a consistent payable period until 2016 and in 2017, this has reduced due to the company adhering to short credit periods. This is a positive sign for supplier relationships. However, the payable period has reduced to approximately 20 days and the company needs to ensure they negotiate appropriate credit periods with the suppliers.

3.3.5.3. Asset turnover ratio

The company requires to utilize assets to generate revenues. It is important that the companies use the assets and maximize the revenue generating potential of the companies. Thus, the companies need to evaluate the asset turnover ratio with a view to identifying the capabilities associated with the revenue generating potential.

Figure 3.12 Asset turnover ratio (AT&T and Verizon communications Annual Reports, 2018)

It is interesting to note that VZ’s assets have been more productive in comparison to the assets of T; VZ has been able to generate turnover worth US$0.50 per an investment of US$1.00 on assets, whilst this value is merely US$0.38 in the situation of T. This highlights that with the same investment levels in assets, VZ theoretically will generate higher values as sales for the company. Thus, the asset turnover efficiencies are higher with VZ.

In summary, it is apparent that VZ has been able to maintain higher levels of efficiencies in the context of payables and asset turnover ratio. However, it is important to note that the receivables period for the company has increased over the past few years and this is one of the main reasons that the company needs to maintain the payables period within the most effective level for the company. If the company is seeking to cut down the payable periods while the actual receivable periods also increase, there is a tendency that they will be heading towards danger in the future.

On the other hand, AT&T requires to work towards identifying ways to increase the productivity levels of the assets and reduce the overall payables period. Meanwhile, the company has been able to maintain the receivables in a consistent manner and this represents a positive sign regarding the company’s capabilities to collect the required funds. Thus, the company will be able to achieve appropriate outcomes and benefit from same, consistent with the expectations of the parties in the future.

3.3.6. Capital structure ratios

The companies need to maintain financial stability in the long-term context; therefore, identifying a suitable capital structure will enable the companies to achieve these requirements. It is important that the companies maintain the required capital structure elements to achieve these benefits in the future. It is vital that there is an appropriate capital structure is maintained over the long term for the parties to achieve the results in line with the needs. The companies need to manage the capital structure with the appropriate focus to achieve the right outcomes. (you need to re-write this paragraph and add some meaningful contents)

Figure 3.13 Capital structure ratios (AT&T and Verizon communications Annual Reports, 2018)

It is observed that VZ has a very high level of debt in the capital structure; currently, the level of debt is as high as 81% of the total capital structure. Therefore, most of the capital structure of the company comprises of debt. This could be considered a problem for the operations since the companies may find it difficult to raise the required capital they need in the future to continue operations. Thus, the above capital structure indicates that VZ requires to evaluate mechanisms to improve equity levels.

AT&T on the other hand possesses a high gearing ratio as well; where the company has a debt level of around 61% of the capital structure in place. However, in the situation of both these companies, the actual level of debt has decreased since 2014. This displays that the companies are making a conscious effort to reduce the capital structure issues and ensure that they efficiently manage the debt levels associated with the capital structures in the future. The following chart indicates the debt to equity ratio associated with the company.

Figure 3.14 Debt to equity ratio (AT&T and Verizon communications Annual Reports, 2018)

The above diagram indicates that the debt to equity ratio level is considerably high with VZ; however, in both instances, the companies have committed to extraordinary levels of debt and the companies need to take necessary action to control and contain the debt levels they are currently faced with. Thus, the companies will be able to ensure that they develop appropriate methods in the future to raise the finances required for the development of 5G capabilities within their networks during the ensuing years.

3.3.7 Market ratios

The market ratios indicate the value placed by the stock markets in relation to the companies; if the markets possess a higher level of trust regarding the companies, it is likely that the market ratios will reflect these accordingly. Therefore, maintaining appropriate market ratios will be important. Further, the changes in market ratios over a period will also indicate the perceived direction of the company in future terms.

| 2013 | 2014 | 2015 | 2016 | 2017 | ||

| PE Ratio | T | 24.42 | 10.34 | 38.23 | 18.02 | 18.6 |

| VZ | 64.66 | 9.77 | 18.94 | 15.56 | 13.57 | |

| Price to cash flow | T | 5.16 | 5.25 | 5.73 | 6.86 | 6.1 |

| VZ | 4.02 | 5.09 | 5.3 | 7.75 | 9.74 | |

| Price to book value | T | 2.14 | 1.88 | 1.74 | 2.11 | 1.91 |

| VZ | 4.02 | 11.73 | 14.33 | 10.64 | 8.04 | |

| PEG ratio | T | 1.2 | 2.49 | 2.88 | 3.03 | 2.12 |

| VZ | 1.2 | 1.11 | 1.29 | 4.4 | 4.56 |

Table 3.2 Market ratios (AT&T and Verizon communications Annual Reports, 2018)

The primary ratios that are being considered at valuation are the Price per earnings ratio (PE Ratio) and the Price Earnings growth ratio (PEG). These ratios remain important and indicates the nature of the expectations the markets have placed on the companies. T has been able to maintain a consistent PE ratio of approximately 18X over the past two years. However, this peaked at 38X in 2015. This displays that while there was a hype in 2015, there was a correction of the price afterwards and the real value of the company was reflected in the stocks. Resultantly, while the company has experienced a decline since 2015, the company has been able to maintain a somewhat consistent PE level.

However, the PE ratio associated with VZ has declined over the past three years consistently and this shows that all the expectations regarding the company have been factored into the price of the shares. On the other hand, PEG indicates the growth and the PE ratio coupled. Meanwhile, it is observed that the PEG has been increasing in the case of VZ, which highlights that market growth is slower. However, in the case of AT&T in 2017, the company has observed growth in the context of company outcomes. Therefore, the recent performance indicators and market indicators have conveyed that markets have a higher level of expectations from T rather than the other options available.

3.4 SWOT analysis

Based on the above analysis, a company based SWOT analysis could be undertaken. It is important to ensure the companies identify the strengths and the weaknesses they possess, to meet the future challenges that they are likely to encounter in the future.

Strengths:

| AT&T | Verizon |

| T has a larger scale of operations compared with the others Has a high level of ability to lobby for positive changes within the industry T has the largest of the customer base in the country T lost only US2.00 in ARPU in 2017 lower compared with the competition T has the widest infrastructure facilities in the US markets currently The company has consistent collection periods | Technology leadership in many areas of the services provided VZ has lower levels of debt in the balance sheet VZ has been able to command higher margins due to technology advancement VZ is more attractive as they generate higher returns than competition |

Table 3.3 Strengths of the two companies (author developed)

Weaknesses:

| AT&T | Verizon |

| The company has a lower ARPU compared with VZ and few of the other competitors The company has lower profit margins in comparison with competition T could be faced with issues with supplier relationships due to the expectations of long credit periods. The overall returns are low and this makes T less attractive to investors The company possessed the lowest customer base in 2017 | VZ lost a part of the customer base, primarily to competitor T-Mobile The revenue is less when compared with the main competitor T The company’s network lags behind the facilities of T and Comcast’s network size The company has lost over US$8 from ARPU in the last year |

Table 3.4 Weaknesses of the two companies (author developed)

Opportunities:

- The main opportunity for the companies arise from the new technology change; namely 5G introduction. The players that would introduce 5G sooner will be able to enter this high margin lucrative market space and benefit in the future.

- Enterprise demand is growing for teleconferencing and data center services; the telecommunication companies could provide these services effectively with the view to maximizing the positive impact thereof.

Threats:

- Price cutting strategies practiced by T-Mobile and other smaller players in the market reduces the margins overall.

All the above aspects indicate that the study has been able to identify some of the main dynamics associated with the market. They will be able to achieve positive results and maximize the benefits thereof. Meanwhile, it is important that the parties work towards management of these aspects effectively and ensure that the results are consistent with the market needs they possess.

3.5 Recommendations

- Both the companies need to develop appropriate methods to improve the revenue; therefore, offering 5G services might be a good idea. VZ is seeking to introduce such services in 2018 and it is also possible that such steps will benefit AT&T in the future as well.

- Both companies require equity finance; it is best that they raise the capital in the form of equity for the investments required for upgrading the current networks to provide 5G services. This will improve the financial standing on the balance sheet and ensure the debt levels are manageable.

- Both companies require to work towards improving the liquidity position of the companies. While the current liquidity levels are unfavorable, owing to the companies possessing large debt ratios they might need to restructuring of the capital structures as well.

- VZ has observed that the credit period envisaged has increased considerably during the past two years. This means that the company is compelled to improve the strength of the collection function with the view to managing these issues effectively. This will also benefit the company in the appropriate context.

Thus, the company who undertakes the above steps will ensure that they will be able to achieve positive results in terms of improving performance levels. Meanwhile, improved financial performance of the companies will lead to increased benefits being offered to the stakeholders of these companies. This will ensure that all stakeholder groups will eventually benefit.

3.6 Conclusion

The paper has identified several facts regarding the telecommunications industry in US; however, the industry has experienced a high level of saturation over the past few years. Therefore, it is deemed necessary that they work towards improving the overall industry context in the future. However, to achieve these changes, it is important to work with the parties involved and ensure that the that the desired results are reached. Meanwhile, the companies need to focus on improving the overall performance levels. They need to work with the stakeholders and improve the revenue potential as well as the profit potential in a sustainable manner. The current outcomes have indicated that the companies need to change certain areas and focus on the capital structure to ensure long term financial stability. Such activities will enable the companies to invest in 5G technology and gain positive results in a sustainable manner.

References

AT&T, (2018). Financial Reports. [Online] Available at:<http://www.morningstar.com/stocks/xnys/t/quote.html>, [Accessed: March, 2018].

BI Intelligence, (2017). Mobile data will skyrocket 700% by 2021. [Online] Available at:<http://www.businessinsider.com/mobile-data-will-skyrocket-700-by-2021-2017-2>, [Accessed: March, 2018].

Calandro, J., (2010). Disney’s Marvel acquisition: a strategic financial analysis. Strategy & Leadership. Vol. 38, Issue: 2, pp.42-51.

Calvert, P., (2013). Research Methods in Information. The Electronic Library. Vol. 31, Issue: 5, pp.682-683.

Cossham, A., (2014). Research Methods in Information. 2nd Ed. Library Review. Vol. 63, Issue: 1/2, pp.167-168

Deloitte, (2016). Telecommunications Industry Outlook 2017. [Online] Available at:<https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/telecommunications-industry-outlook.html>, [Accesed: March, 2018].

.Fourie, I., (2014). Research Methods in Information. Aslib Journal of Information Management, Vol. 66, Issue: 6, pp.702-703.

Gartenberg, B., (2017). Verizon is planning 5G tests in 11 cities this year. [Online] Available at:<https://www.theverge.com/2017/2/22/14696608/verizon-5g-testing-11-us-cities-2017>, [Accessed: March, 2018]

Gautam, O., Sing, V.K. and Sharma, R., (2014). Global Recession and Its Impact on Telecommunication Industry: An Empirical Dissection. International Journal of Management and Business. Vol 5, No 2, pp 107-116.

Lahdenperä, P. and Koppinen, T., (2009). Financial analysis of road project delivery systems. Journal of Financial Management of Property and Construction. Vol. 14, Issue: 1, pp.61-78.

Morris, A., (2006). Provision of research methods teaching in UK LIS departments. New Library World. Vol. 107, Issue: 3/4, pp.116-126.

Nasdaq, (2017). U.S. Telecommunications Industry — Looking Forward to 2018. [Online] Available at:<https://www.nasdaq.com/article/us-telecommunications-industry-looking-forward-to-2018-cm896575>, [Accessed: March, 2018].

Schatz, A., (2014). Wireless Data Demand in U.S. Isn’t Slowing, Cisco Says. [Online] Available at:<https://www.recode.net/2014/2/5/11623098/wireless-data-demand-in-u-s-isnt-slowing-cisco-says>, [Accessed: March, 2018].

Statista, (2018). Revenue of major U.S. wireless telecommunication providers in 2016 (in billion U.S. dollars). [Online] Available at:<https://www.statista.com/statistics/201048/total-operating-revenues-of-us-telecommunication-providers/>, [Accessed: March, 2018].

Statista, (2017). Mobile phone penetration as share of the population in the United States from 2014 to 2020. [Online] Available at:<https://www.statista.com/statistics/222307/forecast-of-mobile-phone-penetration-in-the-us/.>, [Accessed: March, 2018].

Strategy&, (2018). 2017 Telecommunications Trends. [Online] Available at:<https://www.strategyand.pwc.com/trend/2017-telecommunications-industry-trends>, [Accessed: March, 2018].

Verizon Communication, (2018). Financial Reports. [Online] Available at:<http://www.morningstar.com/stocks/xnys/vz/quote.html>, [Accessed: March, 2018].

Zacks Equity Research, (2018). U.S. Telecommunications Industry — Looking Forward to 2018. retrieved from:<https://www.nasdaq.com/article/us-telecommunications-industry-looking-forward-to-2018-cm896575>, [Accessed: March, 2018].

Leave a Reply